Long-term readers will know I have held Telefonica Brasil (Vivo) for four years and been loudly bullish on the company at times. But the thesis hasn’t played out as hoped and the time has come to make way for better opportunities.

It’s the good type of mistake, where you scrape away with a modest gain (20% + some nice dividends), but an analytical error all the same. The company is in excellent shape and is growing a little, it’s just not as cheap as I thought.

In my piece at the time, I suggested that the company could return 5x by the top of the next EM cycle using some heroic multiples and currency assumptions, while commenting on current (2021) value:

VIV is optically very cheap trading on a P/FCF of 9x, an EV/EBITDA of 4x and 7% dividend yield. Of course, basic metrics like this are only useful if they are likely to be a proxy for the future cash flows delivered by the company and I would argue strongly that in this case they are. The blatant cheapness exists because of perceived toxicity of the Brazilian market.

A conservative fair value to a private buyer would be 8x EV/EBITDA (or $16 per VIV share), implying 18x its (likely) growing FCF. This is just above the valuation Liberty Latin America has been paying the likes of Telefonica and AT&T for other telco assets within Central and South America and were good buys, themselves, in my opinion.

What went wrong?

A large part of my thesis was based on the exceptionally low EV/EBITDA- not the first time I’ve been burned on this one. While 4x EBITDA looked great, the P/E was a much less appealing 15x- certainly not a bargain in the Brazilian market. My anticipation was earnings would inflect upwards on lower D&A, bringing the P/E down into line.

This hasn’t happened and today Vivo trades for 16x earnings 2024 earnings (2020 was 54c with a stable BRL:USD over the period). Company FCF is consistently higher than income, allowing for their policy of paying out more than their net income number in shareholder yield (dividends + buybacks). This is great, but also caps the ability to drive strong growth going forward, meaning the current shareholder yield of 6% just isn’t enough. Especially considering the opportunity cost in the current market.

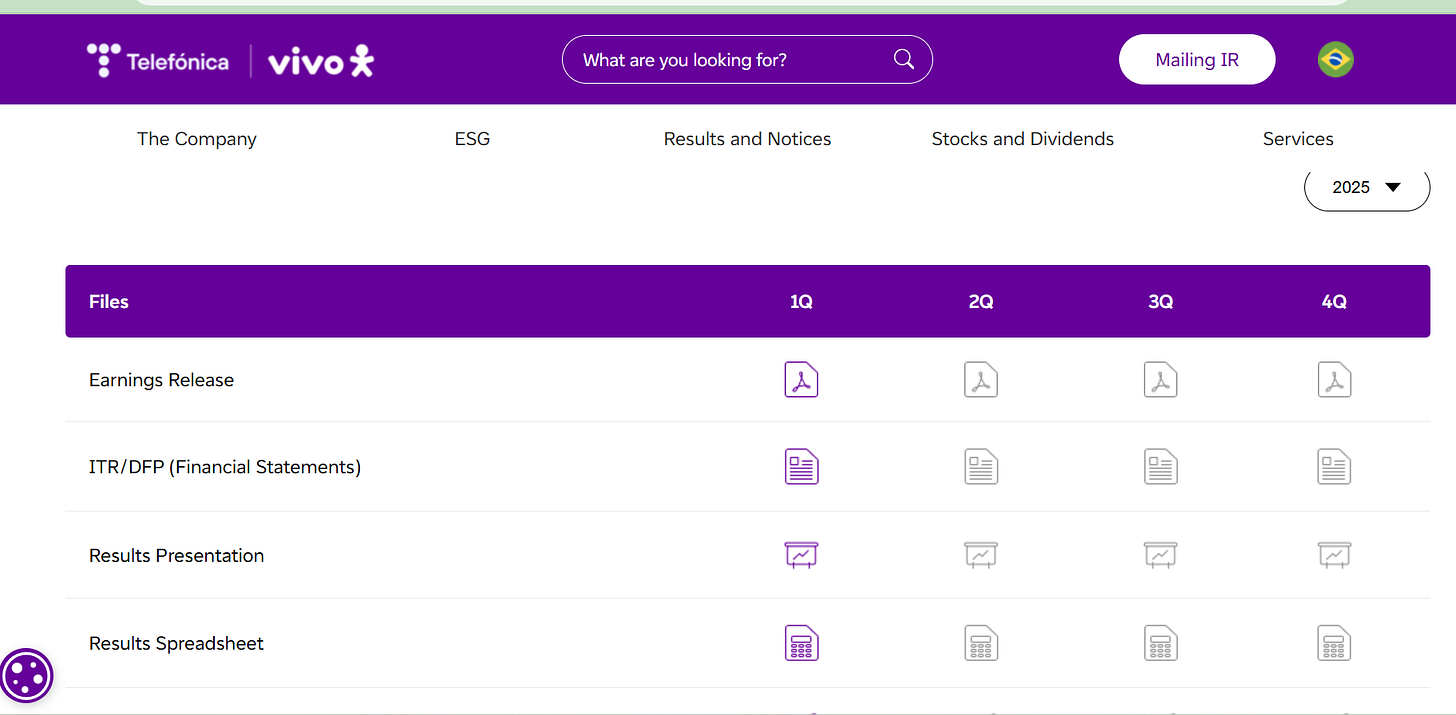

No debt, strong management, shareholder focus and demographic tailwinds make the company appealing so I will fill it away for revisting. I will also miss this beautiful IR layout:

Reallocating

What to do with the proceeds? After the roar back from the Liberation Day slump I simply don’t see as many obvious bargains. I enjoyed AQR’s recent articles taking aim at the cost and unreliability of options and hedging strategies which seems very relevant with the S&P back above 6000. They concluded that simply raising cash levels was more effective protection which appeals to an unsophisticated, long-only practitioner like me.

So while I am currently assessing a couple of opportunities, I’m not in a rush to redeploy and am demanding a very high bar to part with capital.

Guy

PS. The blog quietly ticked over 5 years last month and I’m currently weighing up where to take it going forward. More to come.

As always, this isn’t investment advice and I’m not your financial advisor. Please do your own due diligence and seek professional advice if you’re unsure about your finances.

Telecoms are hard. Earnings estimates show large EPS growth in EPS thought

sounds like my experience with tlk...i expected mediocre management (by EM criteria) to take advantage of their scale and mkt position.

congrats on 5yrs, i hope you always keep an option open to enjoy it regardless of the frequency.