Telefonica Brasil: The Ultimate LBO Candidate

In my last post discussing Petrobras and the Brazilian market's swan dive, I referenced a number of strong companies that I believed were being pummelled by association with their Brazilian domicile. Today I want to flesh out one of these ideas in depth and expand a little on why I think Brazilian equities, particularly bought with foreign currency, are now the most attractive segment in global markets.

Telefonica Brasil (NYSE:VIV) is one of these opportunities. If I had to sum up the thesis on the back of an envelope, I would say that stable cash flow generators, debt free and with strong demographic tailwinds shouldn't be available at 4x EV/EBITDA- they're certainly not in most parts of the world. But, due to Brazil's Covid struggles and president Jair Bolsonaro's latest corporate interference, VIV is one of a number of stable, independent businesses selling at a wide discount to international peers.

The Company

VIV is the leading telecom in Brazil, providing one third of mobile services and growing its broadband footprint (particularly FTTH) rapidly. The company was born in the late '90s when Sao Paolo privatised its telecom assets, selling to the global giant Telefonica. Originally operating solely in the state, VIV began to expand nationally from 2006, most notably acquiring Vivo in 2010, at which point it took the mantle as the country's largest mobile carrier.

Today, VIV has a market cap of R$79b ($14b) and an Enterprise Value of R$76b, due to R$3 in net cash on the balance sheet.

The company is successfully on the path of pivoting away from traditional telco offerings. Fixed voice, ADSL and DTH television are considered non-core assets and only made up 12% of Q4 '20 revenue (down from 20% Q4 '18). The assets within this bucket are declining and saw sales down 21.7% last year.

Core assets include mobile, fibre, handset sales, IP (internet protocol) TV, digital services and data. These saw a mixed 2020 performance due to the pandemic, but overall the outlook is bright and these account for 88% of revenue, within which mobile is 77% and fixed is 23%.

For 2020, handset sales slumped 9%, due to economic restrictions, while mobile revenues were flat, with subscribers up 5%. I believe both are well placed for an economic recovery, with a strong position in a growing market.

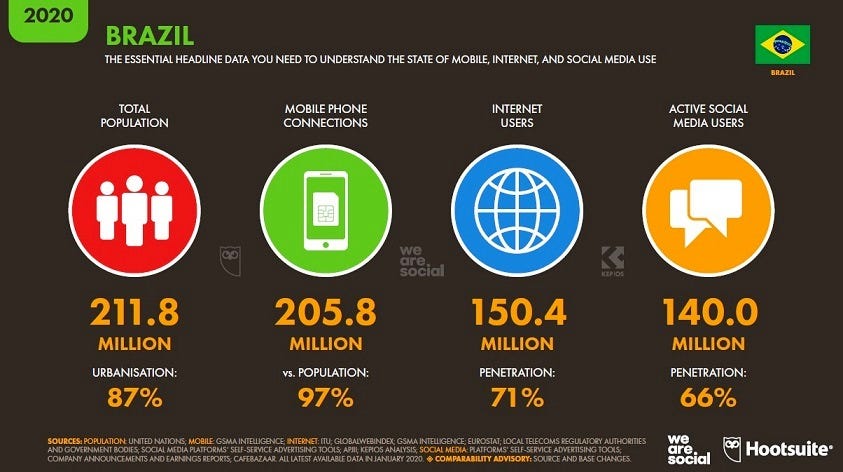

FTTH and IPTV were the true bright spots, growing 50% and 27% respectively. Brazil has a young median age of 33.5 and the desire and need for fast reliable internet will be a tailwind for some years to come. It seems reasonable to expect that the country's internet penetration will grow from the current 71% towards the US and Northern European levels of +95% and within this, fibre will see very strong growth.

Monthly Average Revenue Per User (ARPU) for 2020 was also mixed, but encouraging in the companies core assets. In mobile, monthly ARPU was down 2.5% YoY, but already recovering in Q4, Pay TV declined 5.5% (due to its composition of the rapidly growing IPTV and shrinking DTH) and Broadband/Fibre grew 14.8%.

Management and Capital Allocation

As a rule, I would count the global Telefonica companies as poor allocators of capital. They can generally be counted on to panic sell assets at lows and bid breathlessly at highs. But the record at Telefonica Brasil is much better than its parent.

Christian Gebara has been CEO since early 2019 and overseen the company in a no-nonsense fashion, running the company to target future growth opportunities, while continuing its consistent cash flow and and dividend streams. Gebara has been with VIV for a decade and I believe he can be relied upon for steady and unspectacular (safe) management.

It is unrealistic to hope for a Warren Buffett-level allocator at an EM Telco, but one is also not necessary at a dependable company priced this cheaply. A steward who will do no harm is, likely, enough for great results and Gebara has overseen low single digit percentage buybacks over his time. These were paused for most of last year but have commenced again, with R$58.4m purchased (.8% of shares outstanding) under the current program which lasts until 2022.

He has also overseen the reasonable acquisition of bankrupt Brazilian carrier Oi's UPI Mobile assets, which will close in late 2021. Needless to say, being the sole bidder at an auction for bankrupt assets is a the sort of expansion I approve of! The company won a joint bid with TIM and America Movil and its share will be 10.5 million new mobile users for a R$5.5b ($980m) outlay.

The deal will add R$3.7b to net mobile revenues, if the current rate of revenue per mobile subscriber (R$359/yr) converts over and will assist with expansion into new markets.

While empire building is disastrous mindset in a capital intensive business like telecom, the company's net cash balance sheet is evidence that it's not happening here. However, VIV is taking advantage of scale achieved sensibly, as the company discusses in its annual report:

Our Vivo brand, under which we market our mobile services, is among the most recognized brands in Brazil. The quality of our services and the strength of our brand recognition enable us to, on average, achieve higher prices relative to our competition and, as a result, generally earn higher margins. As of December 31, 2020, our average revenue per mobile user, or ARPU, of R$29.06 represented a significant premium relative to the market average.

The dividend policy at VIV is one of the chief attractions of the company- it is committed to paying out 100% of its earnings- and as free cash flow is much higher than net profit, this still allows room for small buybacks and growth. This situation may not be sustainable forever as the company continues to expand its fibre network, but is currently possible due to the run-off of the fixed line network, which won't need significant capex as it declines.

This lag may make it possible for VIV to roll-out its fibre network at a steady rate, to stay ahead of its depreciation, spread out its capital spending and maintain its healthy cash generation.

Free cash flow rose 12.6% in 2020, due to capex discipline, but I am assuming it reverts back to 2019 levels post-Covid (R$8.2b or 10% FCF yield), still allowing continued and comfortable coverage of the 7% dividend yield and modest buybacks.

Brazil's lost decade

Brazil has gone from on top of the world a decade ago, flying high as one of the glorified BRICs, to a crippled economy most allocators wouldn't touch with their worst enemy's money.

There has been the impeachment of the country's first female president (Dilma Rousseff), the jailing of another (Lula), rolling recessions and the full brunt of the Covid pandemic. Predictably, this has left very few international buyers on the scene, with the Brazilian market currently sitting at its 2008 GFC lows or 1/3 of its 2007 highs (in USD). This lays bare the devastation of a currency that has lost 70% of its value since 2011.

The chart below, from GMO's excellent "It's Always Darkest Before the Dawn", shows that Covid added further insult to a decade of injury, with Brazil's equities and currency being hit the worst of a sample of particularly volatile EMs, through the first stage of the pandemic.

This is where position sizing is difficult. I have a high degree of confidence in the future success and dependability of VIV, but I have no ability to know if there will be further upheaval within Brazil. Situations like this are why a portfolio should be diversified across geographies and currencies.

Having said that, there are a number of reasons why I feel confident about the macro environment. Uncertainty is something we are paid to bear as investors and I believe the margin of safety on offer is enormous. While I have no idea what the Real will do in the next year, I know that it is down a long, long way over any time frame you choose and has a lot of pain priced in.

Similarly, Bolsonaro's unpredictability and populist tendencies are no secret to the market. I am always buying assets that I hope to hold for the next cycle, so if Brazil is ever considered as simply a normal EM (as opposed to a basket-case), the Real will likely be much higher. In my opinion, the possible surprises skew heavily positive given the valuation.

Covid

Even though it seems ridiculous to say when looking at the stock price, VIV wasn't a clear Covid loser. Instead the pandemic served to hurt the non-core businesses it is exiting anyway and boost its growth efforts in fibre and IPTV. As stated above mobile was neutral, with lower handset sales, due to operating restrictions, and lower roaming charges, but mobile subscribers rising by 5.3%.

Overall revenue declined only modestly, from R$44.2b to R$43.1b YoY and the company is in a strong position to bounce back where it suffered and extend gains in its growth businesses. Brazil has obviously been hit harder by Covid than most countries, but taking a full cycle view, it seems full of striking opportunities given the virus will likely be looked back on as a blip in a decade.

Verdad Advisors recently released an excellent analysis of investing into stock crashes within EMs, that seems relevant to Brazil today. In their paper "Emerging Markets Crisis Investing", they draw a sharp distinction between crashes that occur specific to a particular EM country (ie. Greece in 2011 or Turkey in 2018) and those that are part of a broader global crisis, which drags down all markets indiscriminately (and often EM more harshly).

They find that global crashes create spectacular buying opportunities in EM, with a very high recovery rate, while country specific debacles have more chance of being terminal and require a weary tread.

Brazil has occupied both of these buckets over the last decade, with the rolling political turmoil, corruption and recessions clearly country-specific. However, markets in Brazil were on a path to recovery by early 2020, with many equities rising strongly. I would argue that the Covid drawdown can be viewed separately and placed into the global crisis category. It intuitively makes sense that as one of the worst affected (and a commodity economy), the country now has the most to gain through successful vaccines.

Valuation

As always, I like to think about my positions through a lens of fair value both today and over the cycle.

VIV is optically very cheap trading on a P/FCF of 9x, an EV/EBITDA of 4x and 7% dividend yield. Of course, basic metrics like this are only useful if they are likely to be a proxy for the future cash flows delivered by the company and I would argue strongly that in this case they are. The blatant cheapness exists because of perceived toxicity of the Brazilian market.

A conservative fair value to a private buyer would be 8x EV/EBITDA (or $16 per VIV share), implying 18x its (likely) growing FCF. This is just above the valuation Liberty Latin America has been paying the likes of Telefonica and AT&T for other telco assets within Central and South America and were good buys, themselves, in my opinion.

While I don't expect this to happen, the following thought experiment reveals just how cheap the company is and the reason for the title of this article. While VIV is debt free, it is an exception within the telco industry. Any acquirer would be applying leverage and likely achieve strong returns, but would be paying a take-over premium to do so.

However, Telefonica Brasil could effectively do this at the current depressed multiple. If the company were to theoretically borrow half of its market cap and carry out buybacks around current prices, the result would be an unchanged 4x EV/EBITDA, but a super-charged FCF yield of 15% (R$39b market cap and levered FCF of R$6b, derived from R$8b unlevered FCF minus 5% interest on R$39b debt).

Longer term, I believe the company has a high chance of delivering a 5.5x return by the top of the next cycle and that my assumptions are reasonable:

-In a world where Brazil is no longer a hated market and Covid is a distant memory, possibly driven by a upswing in EM markets as a whole, an EV/EBITDA of 10x is very possible.

-A recovered Brazil, towards the top of the next cycle, would also have a much stronger Real, with a recovery only half-way back to 2011 levels translating to a 2x for USD holders.

-I am making no allowance for modest buybacks and growth slightly above GDP, although these are partially reflected in my assumed multiple.

-5-8 years of dividends approximating a 50% return.

Conclusion

An expensive global market doesn't like to give free lunches and businesses with demographic tailwinds and consistent cash generation are rarely offered cheaply, without a catch. In Telefonica Brasil's case, this has very little to do with the company and a lot to do with Brazil and its Covid response.

However, a value investor's job is to assess uncertainty and decide whether they are being paid to take it on. With vaccines rolling out and VIV still at multi-year lows, I would argue the margin of safety is enormous and the possible outcomes skew heavily positive.

I have positions in Telefonica Brasil (6%) and Petrobras (5%), established over the last fortnight, and a long-term position in LILAK (11%).

Guy

Please don't take this as financial advice. Do your own due diligence and consult a professional advisor if unsure about your finances.