For calendar year 2023, the Superfluous Value portfolio gained 24.9%, modestly outperforming the MSCI ACWI IMI which rose 20.8% (both in AUD). The Aussie Dollar was flat for the year implying a near identical return in constant currency (USD).

Since I began formally tracking my portfolio in Aug 2018, I have gained a cumulative 54%, underperforming the index which has returned 55.4% (both in AUD) by .2% per year.

It was a good year and one I needed after a rough 2022.

The bulls are charging on the main indices again led by the cringeworthily-named Magnificent Seven, but my returns were achieved with a decent cash balance and no US Large Cap exposure, so I am hopeful about their sustainability going forward.

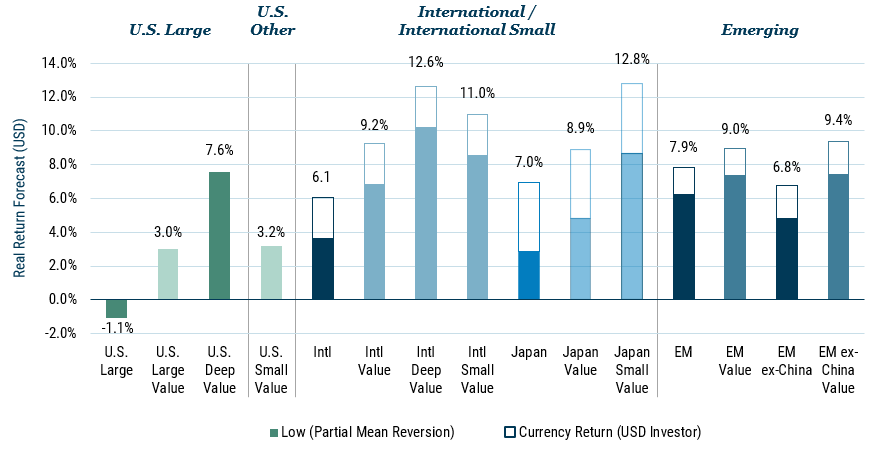

Most importantly in this regard, the portfolio remains defensibly cheap across a number of metrics, in direct contrast to the NASDAQ et al. A recent piece from GMO’s Asset Allocation team highlights the point nicely. The deep value opportunity/spread continues to hover at historically wide levels.

The Superfluous Value portfolio benefited from four of its largest positions having a very strong year. Most meaningfully was Cameco, which doubled as the uranium bull market got into swing. I continue to mull the company with it currently sitting at a slightly uncomfortable 16% position and much closer to fair value than my December 2020 entry point.

Management has successfully completed the turnaround of Babcock International with the market re-rating the company over the last year in response. I trimmed the position recently with the stock now around 12x my estimate of normalised earnings.

Recent purchase Companhia Brasileira de Distribuição played out somewhat as I predicted here, with the spin-out and sale of its Columbian supermarket business at a nice premium. I sold my EXTO shares into the tender, but continue to hold the orphaned remainco CBD, which is one of the most volatile issues I have witnessed. Liquidity is poor and I suspect a number of Exito shareholders consider the trade complete and don’t care what they sell CBD for.

Petrobras also contributed strongly, up over 50% + dividends off a low base. Interestingly, we have just had another bought of Lula fear, with the company witholding special dividends for Q4. I wrote about the situation here and believe it’s worth waiting out. The company trades at 4x earnings with a 13% dividend yield.

Poor performers included Antero Resources, which trades at very modest levels and has greatly improved its debt situation since 2020. Nat gas remains in the dumps and I anticipate it will have to rise as the global supply continues to adjust, post the Russian invasion of Ukraine.

As mentioned in my H1 review, I was a forced seller of ABS CBN as my broker decided to remove access to Filipino markets. I exited at a loss despite having several periods were I was well ahead on this one. It is an example similar to LILAK or Aimia, where the lack of a dividend can make the opportunity cost of owning holdcos like this very severe if they don’t perform.

Aimia remains in the portfolio much to my chagrin. Mithaq Capital attempted to buy out the company at a price I would have been happy to walk away with, but didn’t get the 50% control to see the deal succeed. The company descended into farce over 2023, with a fall-out between the Mittleman brothers at the head of the company ending up in court. Details included allegations the former CEO had hired his college roomate into the company presidency on $800k/year, when he had been unemployed for five years previously. This piece makes for hilarious or blood-curdling reading depending on whether you are a shareholder or not.

New addition Pan American Silver also detracted as precious metals miners remained under pressure. There’s a ridiculous amount of value in the company and I’m happy to wait the current sentiment out. The current price implies no value for their Escobal mine in Guatemala which is currently halted, but undergoing consultation over a possible re-opening that would satisfy various local groups. Escobal is one of the world’s largest primary silver deposits with enormous reserves. I believe that precious metal miners currently look a lot like energy investments in 2020- left for dead- and a return to favour should see a scramble to jam into a fairly small market cap sector.

Gazprom and Lukoil remain extremely valuable, but unable for me to access for now, so I will pause mentioning them each half unless something noteworthy happens. I will continue to mark them to zero until proven otherwise. It’s a kind of handcuffed coffee can approach.

The portfolio consists of 18 positions and 12% cash as of writing.

Top Holdings

The portfolio’s top five positions are currently Cameco (16%), Millicom (8.1%), KT Corp (6.7%), Petrobras (5.6%) and Telefonica Brasil (5.5%).

I intend to update every stock in the portfolio when I review the first half of 2024 in a few months.

Summary

As disturbing as it looks now, at one point in 2022 I considered making Aimia and LILAK “big bet” style positions of 20% and 12% respectively considering them to be my best ideas. Luckily I did not, but the performance since has driven home how little we actually know about the fickleness of markets. My Russian experience could go in the same category and has made me more aware of diversifying against my own ignorance if I intend to continue investing my family’s hard-earned money.

Consequently I am slowly transitioning from a 15 stock portfolio towards holdings. Mostly by initiating positions at a 4% weight, as opposed to my previous 6%, and being more ready to trim and recycle. Cameco is obviously a problem for this new outlook and I hope to have the chance to trim it soon.

2024 has started well and I wish you all best of luck for the year. There are plenty of opportunities for those willing to look in the bargain bin.

Regards,

Guy

I own positions in all the companies mentioned.

PS. As always (and especially when I'm mentioning so many stocks), this isn't investment advice. Please do your own due diligence and seek professional advice if you're unsure about your finances.

Really appreciate these posts. They've been very helpful. Have you looked at Helios Towers? Given your EM and Telco exposures, it might be interesting. Trading at 14% steady state FCF yield (after interest expenses). Good business, good management.

What do you think of the new Aimia management?