2022 Portfolio Review

For calendar year 2022, the Superfluous Value portfolio fell 12.4%, essentially steady against the MSCI ACWI IMI which lost 12.5% (both in AUD). The declining Aussie Dollar, once again, proved a tailwind, as I was down 16.3% when measured in constant currency (USD).

More importantly, since I began formally tracking my portfolio in Aug 2018, I have gained a cumulative 23.3%, underperforming the index which has returned 28.6% (both in AUD).

Despite matching the index, it was a year of missed opportunity for the portfolio. As I discussed in my H1 review, a few critical errors ate into what could have been a year of substantial outperformance. Namely, Gazprom and Lukoil entering sanction-purgatory, and Italian energy-services provider Saipem announcing cost blow-outs, necessitating a heavily dilutive capital raise.

Luckily investing is forward looking and hope springs eternal. While I continue to mark my Russian securities at zero, wars don’t last forever and I was able to convert my ADRs into Moscow-listed shares in the second half of the year. I have also seen a nice gain on my participation in Saipem’s Rights Issue and things are finally starting to look up for the sector- last year’s losers may yet serve well in the future.

The rest of the portfolio put in a nice performance for the period, in a year where value finally held its ground as recent fads collpased en masse. Major contributors (at least non-losers) came from energy, including Cameco, Petrobras and Antero, and my trusty non-US, deep value names Babcock International, Lloyds Bank, KT Corp and Telefonica Brasil.

It likely sounds trite, as I’ve been saying this for a number of years now, but the portfolio remains incredibly cheap and I believe a very strong period lies ahead. We are arguably seeing all the signs of a regime change now, with rising rates allowing the market to appreciate shorter-duration stocks (those paying out substantial cash flows today).

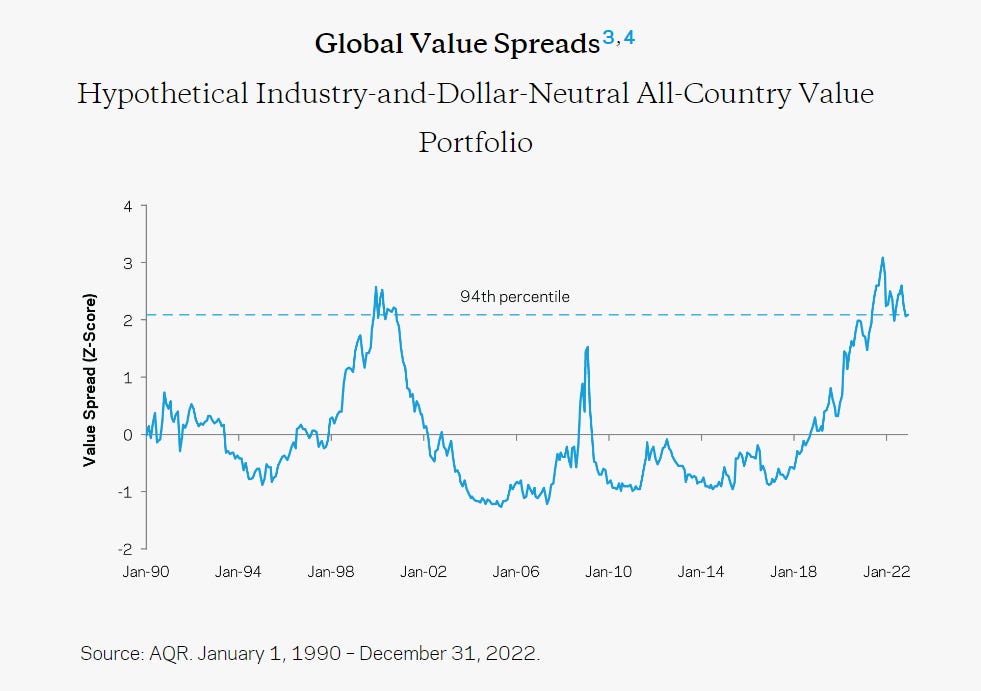

The valuation-divergence in the market remains stunningly wide. Despite the S&P 500 seeling at a CAPE ratio of 28x, it is quite achievable to look elsewhere and build a portfolio of resilient companies trading at mid-single digit P/Es and P/FCFs, 50% discounts to NAV and low-single digit EV/EBITDAs. The AQR chart below illustrates the value-growth spread still at levels only briefly touched during the Dot-Com Bubble.

In my H1 review, I referenced Micro Focus and ABS CBN as poor performers with time against them. Within weeks of writing, they were both very nearly “solved”. Micro Focus recieved a takeover bid from OpenText at a 100% premium, which has since closed, proving good things happen to very cheap stocks.

ABS CBN announced its intention to merge with Manny Pangilinan’s TV5 (MVP is also Managing Director of another of my holdings- First Pacific), sending the share price rocketing. Unfortunately, it was to be short-lived as Filipino, political grudges reared and enough pressure was applied to squash the deal. Anyway, one out of two dealt with is a start…

Through a combination of the Micro Focus deal closing in February, healthy dividends and the Davis family savings rate, the portfolio is up to 28% cash. This is obviously a good problem to have in a target-rich environment and I am currently weighing several excellent opportunities.

Turnover remained pleasingly low, with my Millicom purchase and Saipem Rights participation my only activity for the year. I apologise if it makes for repetitive reading, but I am convinced minimal and efficient decision-making is a key to investing success.

The portfolio consisted of 17 positions at December 31.

Top Holdings

Cameco (12%)

In October, Cameco announced their purchase of nuclear services business Westinghouse Electric, in a strategic partnership with Brookfield Renewables (Cameco 49% ownership) for a $7.9b EV. There was heated debate about whether this was a top-of-the-cycle de-worsification. I believe it looks reasonable and the integration has positioned them as the only game in town, when North America (and the greater west) ramps up nuclear energy, as a carbon-free source.

Many have argued that Cameco is overvalued throughout my holding period and I would agree that it looks fairly priced at current spot pricing, but the long-term story continues to improve, with new demand regularly emerging and the credentials of nuclear energy entering the mainstream. As a thought experiment, despite uranium ultimately supplying 10% of global energy generation, Cameco and Kazatomprom (the world’s only producers) sell for a combined $17b market cap. This seems absurdly low to me, especially as that number includes significant infrastructure as well (half of Westinghouse).

My fair value today is around $35/share, but I have a feeling that I would regret it down the track if I were to take that price in the near future, so will continue sitting tight.

Millicom (9%)

As sure as night follows day, Millicom commenced my ownership period by falling 40% between May and September. However, the company represents the best of both worlds, in my opinion. You have a neglected EM asset trading at a deep value price and a western management with skin-in-the-game, pulling the levers.

Private transactions in Latam telco take place at 6-7x EBITDA, and yet Millicom trades for <4x, despite its fibre-heavy profile and clear plan to commence substantial buy-backs. There is also the coming monetisation of their 10k tower assets and their small, but rapidy growing, digital business TIGO Money.

The company has recovered strongly off its 2022 lows, due to a buy-out/bidding war situation emerging with former Softbank exec Marcelo Claure offering a low-ball bid and now French billionaire Xavier Niel announcing a 20% stake. Watch this space.

Babcock International (7%)

Babcock has pulled off the impressive feat of being a defence company with a lower share price today, than before the Russian invasion of Ukraine. This is despite its prime expertise and location to take advantage of beefed-up EU defence spending.

David Lockwood has done a creditable job, since taking over the company in turmoil. He has sold non-core divisions and reduced net debt to less than 2x EBITDA, a task that seemed a long way off, only two years ago. The company is still seeing margin pressure due to inflation, but is working hard to negate it.

My fair value still assumes EPS will recover to 40p/share (currently 30p) as conditions improve and should see a 15x multiple for a price of 600p.

KT Corp (6%)

It was another year of little movement in KT’s share price. The company is a good example of a nice dividend (6.5% yield) going a long way while waiting for the company to catch a bid. It continues to trade ridiculously cheaply at 2.5x EBITDA and 5.5x earnings, despite a recent step up in FCF, due to completing the bulk of their 5G capex roll-out.

My whole investment philosophy is based around mean reversion/outright cheapness and for it to be sound, a stock like KT needs to outperform eventually. I remain highly optimistic this will be the case.

Telefonica Brasil (5%)

Today, Telefonica Brasil can be bought lower than its March 2020 lows, this makes sense because… I’ve got nothing.

Pre-pandemic (CY2019), the company earned $R16b in EBITDA vs $R19b last year. It remains very modestly indebted and is paying out 96% of FCF through dividends and buybacks. Like TIGO, it has a digital payments business that it is growing with the idea of an IPO or sale in the future. The company trades for 3.6x EV/EBITDA, is likely under-earning and should do very well whenever the dark sentiment towards Brazilian equities turns.

Of Further Interest

Aimia

I will dedicate a whole post to Aimia when I get the chance, but it has been a transformational twelve months for the company. After closing the sale of their stake in PLM to Aeromexico and receiving substantially more cash than their market cap in the transaction, the next question was what would management do with the money?

Many were calling for share buybacks, but this would have been a waste of the substantial tax credits (C$660m) accumulated under previous management. Instead they have decided to grow the pie, announcing the acquisitions of Indian industrial net and rope-maker Tufropes and Italian specialty-chemicals manufacturer Bozzetto for a combined C$585m, representing 8x their combined C$72m EBITDA for 2022.

These are not deep value multiples, but the price seems attractive considering both companies have a history of strong growth and high FCF conversion.

Pro forma the transaction, Aimia’s enterprise value will be C$362m (market cap+net debt) and I calculate other assets at $280m (Trade X and Kognitiv at 50% discount to holding value+Clear Media+Precog+SPVs+rough NPV of tax assets).

Then taking C$12m in preferred share dividends (management views these as equity-like and has no plans to pay them down) and C$15m in head office costs from the C$72m in EBITDA, leaves C$45m, for which the market is effectively paying C$82m or 1.82x EBITDA.

Some level of holdco discount is probably justified, but this price is just too cheap and will look absurdly so, if Tufropes and Bozzetto continue to grow strongly. Management has the funds and skin-in-the-game to be aggressive about buying back stock and force this recognition.

Summary

It was a frustrating year, but I am gratified to have stuck to the index despite several mistakes. As I write this in the wake of the Silicon Valley Bank blow-up, I am very excited by the current opportunity set. I believe now is the time, more than ever, for contrarian stock-selection in the face of a dangerously expensive headline market.

As always, thanks for reading and the support,

Guy

I own positions in all the companies mentioned (except Kazatomprom and SIVB-lol).

PS. As always (and especially when I'm mentioning so many stocks), this isn't investment advice. Please do your own due diligence and seek professional advice if you're unsure about your finances.