The Bubble Isn't Where You Think It Is

Just a short pre-Christmas note today.

A number of market pundits have been giving the all clear to jump back in the pool now that crypto has been nuked and Peleton et al are down 80%+.

Yes, those were bubbles of the more ridiculous variety, but the S&P 500 is still dangerously expensive and growth stocks are not the sole reason.

Under the hood, the index is stuffed with mature industrial and consumer businesses still trading well above their historical norms.

A number of reasons have likely combined to allow this, namely the flight to USD assets, their (decade-long) bond-proxy status and the recent popularity of quality investing, but they are unlikely to last and will seem a little crazy in hindsight. Not 60x Sales-type of crazy, but maybe this is why they have slipped under the radar in recent years.

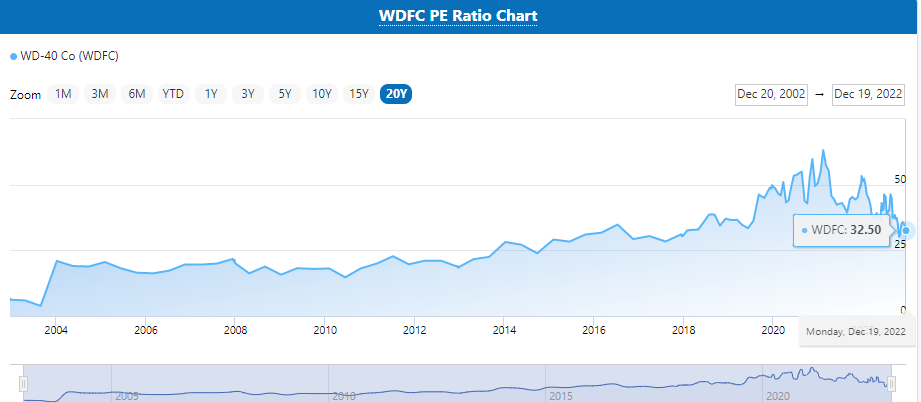

Exhibit A, WD-40 Company:

Even after severe price compression this year, WD-40 trades for 32x what are likely Covid-juiced earnings.

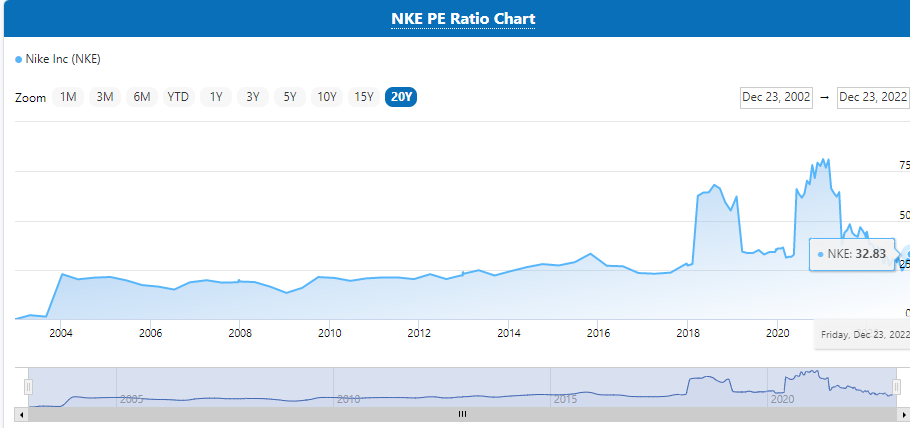

Similarly, Nike at 33x:

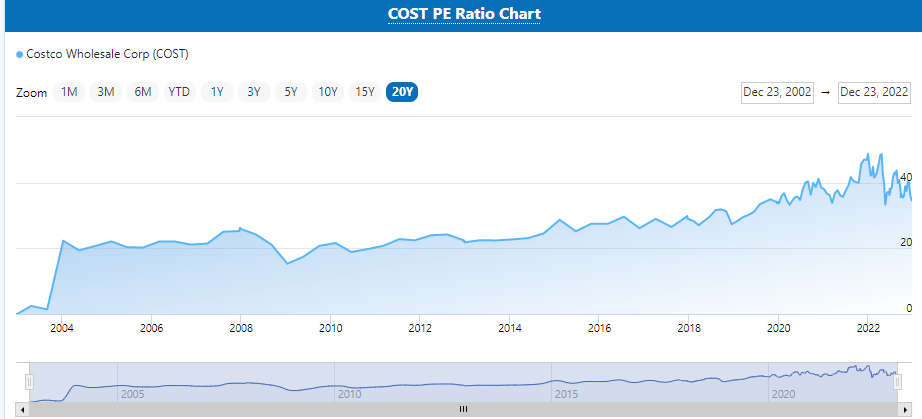

Costco at 35x:

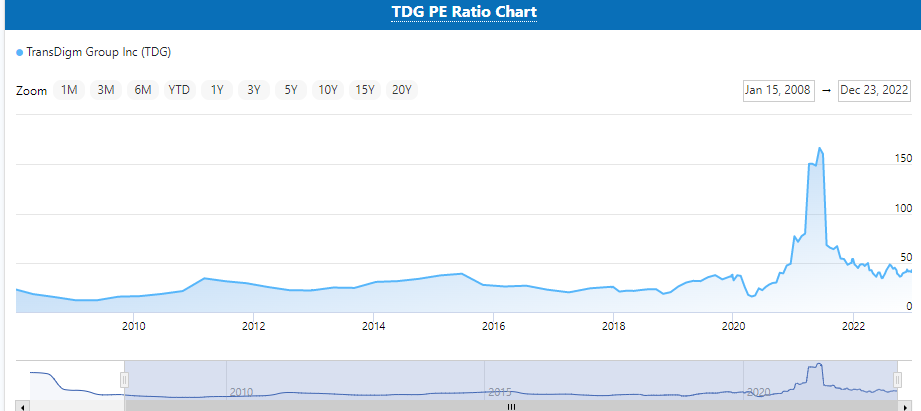

Or Transdigm at 42x:

Barring some pandemic distortion, all are significantly more expensive than their post-2000 averages and are likely to see Full Year earnings pressure, through a combination of labour costs, commodity inputs and post-Covid behaviour normalisation.

Concerningly, I had many more examples to choose from here. While most stocks are down this year, they remain well above levels that reflect their rapidly rising cost of capital and likely headwinds.

This will come as no surprise to regular readers, but I remain deeply bearish on the S&P 500, despite the modest price cut this year, so patience and picking my spots will remain critical into 2023.

Thanks to those that supported Superfluous Value this year. Wishing you and your loved a happy and safe holiday season!

Guy

As always, this isn’t investment advice. Please do your own due diligence and seek professional advice if you’re unsure about your finances.