Teekay Corp: A near net-net, special situation

I am quite wary of the shipping industry, due to an almost flawless tendency towards value destruction, but have been following Teekay Corp (NYSE:TK) for several months after the recent sale of its LNG division has left it with enough net cash to cover its market cap.

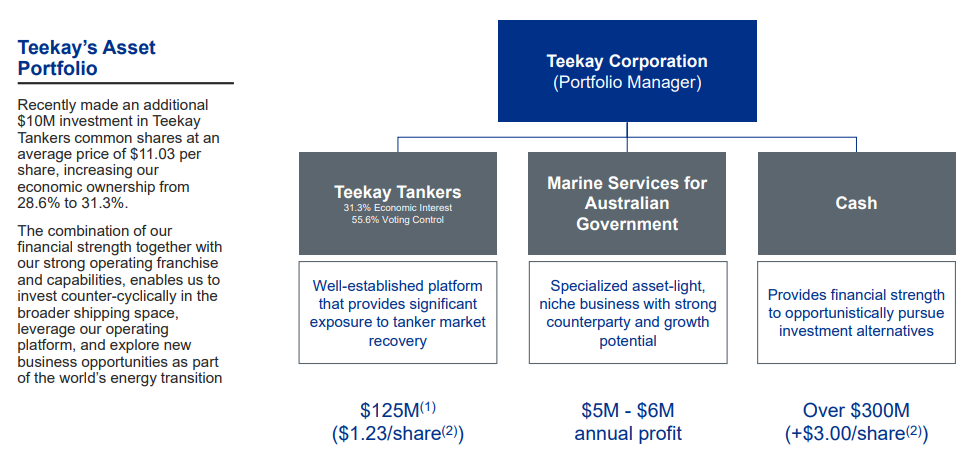

The group was founded by Danish shipping broker Torben Karlshoej in 1973 and has headquarters across the globe today. It has been an integral part of the shipping landscape since, spawning names such as Petrojarl and Golar-Nor, as well as plenty of strategic activity including the sale of Teekay Offshore to Brookfield in 2019 and Teekay Tankers (in which it holds a 31.3% interest).

The margin of safety seems generous today at a $333m market cap. The situation is remarkably simple and summarised below:

In terms of liquid assets, Teekay today has “over $300m” cash left after the LNG sale proceeds were used to pay down debt and the stake in Teekay Tankers (NYSE:TNK), worth $165m at the Friday close. TK trades at 72% of this $465m asset backing.

Additionally the group has signed an ongoing marine services contract in Australia that it has described as “asset light”. This generates $5-6m in annual profit and could reasonably be valued at 10x, in my opinion, adding another $50m to a reasonable fair value- indicating a 35% margin of safety.

This is all that will be left of the business after the decommisioning of Teekay’s two remaining FPSO (Floating Production, Storage and Offloading) vessels are completed later this year.

The discount wouldn’t be quite enough to get me interested normally, but a rule I have tried to implement (with varying success) is that if you take care of the downside in an investment, the upside should work itself out. It seems pretty hard to lose money with cash covering your investment and a few other options thrown in for free.

The real game-changer is whether Teekay can be expected to grow its NAV/share. If this could be achieved, today’s price will likely look like a bargain in hindsight.

There are a few ways this could be achieved. The most obvious would being a buyback, hoovering up the float, lifting NAV/share and closing the discount by force. At some point owners would simply own Teekay Tankers at a huge discount, with the services operation as a bonus. Unfortunately this doesn’t seem likely, as management has indicated they intend to reinvest the funds back into the shipping industry as opportunity allows.

Continuing to accumulate TNK stock would also be value accretive, and this course is highly likely, as they have already spent $10m doing so since the LNG deal closed. Hopefully management will continue and step this up, as the tanker industry has been in a deep depression for the best part of a decade, from which it may be just emerging.

The long-term TNK chart (below) is fairly typical of the tanker industry. The combination of Covid supply interuptions, then rising commodity prices and now the war in Ukraine have finally started to bump up day-rates and the recovery to could be significant if these companies can receive some inflows again.

Management commiting to reinvest into the industry is the most double-edged option. If shipping is indeed on the verge of a recovery, the more related assets Teekay can accumulate the better- but you have to ask why they just sold their LNG division this being the case?

CEO Kenneth Hvid and CFO Vincent Lok are clearly experienced and skilled operators (both also have more than 20 years at Teekay) but their capital allocation timing could be criticised. The deal with Brookfield for Teekay Offshore ended up as something of a bargain take-under and the recent LNG deal will already have created significant value for the buyer.

A worst-case scenario could be an acceleration of the current bullish price action making Teekay panic to get back in and overpaying, as the liquidity proves an opportunity cost.

Cash flow will be another significant factor, as TNK doesn’t pay dividends and the holdco will have to meet its costs. The only cash coming in for the immediate future will be the services contract.

Currently, Teekay is forecasting Q1 G&A expenses of $15m on a consolidated basis and TNK has seperately guided to $10m, leaving $5m for Teekay Corp to cover. I assume this will be lower in further quarters, as the winding down of operations will soon conclude, and estimate normalised annual costs at around $15m (or about $10m of annual cash burn, after services income).

Given I am currently holding my cash fairly close to my chest, I have passed on TK to this point, but am very interested to follow if the discount widens in any broader market sell-off. I believe it would be an outstanding buy at a 50% discount to NAV.

Whether it gets there and what other opportunities would be available at that point remains to be seen.

I have tried to keep this shorter than my normal posts, beacause not only is the situation fairly simple, but there are a plethora of similar blogs out there atm and I know evryone’s time is valuable. If you feel like this was too simplistic, please let me know, as this blog is a work in progress, despite recently ticking over the two year mark.

Thanks for reading,

Guy

be extra wary about being on the other side of brookfield...it is not always clear where that is !