Saipem: Too cheap to Ignore, Safe Enough to Survive

Despite the rally in energy services since November, the sector remains one of the cheapest in global markets, with many businesses grinding lower over the seven-year bear market, only to then be totally decimated during the pandemic.

After having spent a huge block of time working through the sector over the last 12 months (including pounding the table on energy last September), my preferred investment in the space is the Italian, former-giant Saipem (SPM.IT).

Energy has been a rotten sector for many years now and within that cluster of unbelievably cheap stocks, there are what I consider the esoteric situations that may make a portfolio over the next cycle. Esoteric because they have something about them that makes them untouchable, even in a sector that is arguably the most hated in a generation, such as a non-Northern American domicile or heavy operating leverage.

Saipem has both and has underperformed the burgeoning energy recovery for this reason. Consider the enterprise value of the business over the commodity cycle:

As is clear from the above table, approaching the last energy peak (during the early 2010s), the market was happy to pay a Price/Sales of 1.2-1.5x on what would end up being peak revenues. Whereas today, the clearly nauseated market is paying less than 1/3 of 2020's horror show sales, having been even lower at various points last year.

Whether 2020 will prove to be the cyclical low is yet to be seen, but a value investor must act on opportunities as they present themselves, knowing that by the time the future is known, the price will likely be much higher.

A vital step in assessing the upside in a business with the operating leverage that comes from servicing a commodity sector, is to know that it will survive out the other side of the current nadir and in this regard I regard Saipem as quite safe.

The company already went through a painful, dilutive equity raise in 2016, which reduced leverage from nearly 5x EBITDA, to 1.5x- where it remains roughly today (1.8x pre-IFRS change, to compare apples to apples). Liquidity also appears ample at 2.5b€, with 1.5b€ in cash and equivalents and a undrawn revolver of 1b€.

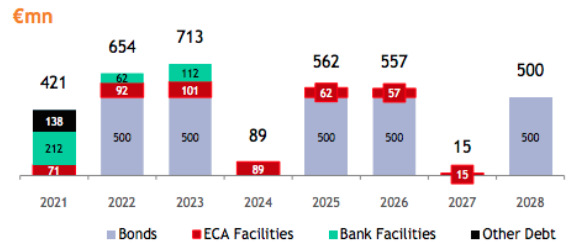

Debt maturities are evenly spread until 2028 and despite the recent news of a force majeure at the Total LNG project in Mozambique casting a cloud over 4b€ in revenues (out of Sapiem's 25b€ order book), all the companies bonds trade at par in the market. In my opinion, the equity market is pricing serious distress where there simply isn't any.

The Business

Saipem has roots back to the 1950s and spent many years as a subsidiary of the Italian oil super-major Eni, which maintains a 30% stake today. Highly respected investors Marathon Asset Management also own 5% of the company, worth 100m€.

The company is well diversified across the energy space, with the current E&C (Engineering and Construction) backlog breaking down to 67% gas, 22% oil and 11% renewables and infrastructure. Saipem also gave insight into its future contract opportunities in Q1, estimating a much higher oil component (44%) of future work, due to strong wins and their outlook for the Middle East.

Company leadership has just transitioned with the long-standing CEO Stefano Cao retiring, however I expect more of the same steady, but unspectacular, management with the role passing to the Chairman Francesco Caio.

Saipem breaks its business down into five divisions, namely Offshore E&C, Onshore E&C, Offshore Drilling, Onshore Drilling and XSIGHT (an internal, energy-innovation start-up, whose numbers are not yet material and therefore reported in Onshore E&C). Of these, Onshore E&C is by far the most material contributing around 2/3 of revenue, followed by Offshore E&C at around 1/4.

The Offshore E&C division owns a diversified fleet of 28 vessels and will likely see a strong rebound out the pandemic hit. The sections Q1 revenues were 557m€, down 33% YoY, but as with the whole industry, Q1 2020 proved to be mostly unaffected by the Covid turmoil. The first quarter saw wins and extensions from Qatargas and Saudi Aramco, as well as a renewable contract for EODC in France. Saipem has guided that the recovery in OE&C will not come before the back half of the year.

Onshore E&C is a juggernaut for Saipem, generating over half its revenues. The operations are diverse by geography and client, including many of the energy supermajors and the company has a strong reputation for complex and nuanced projects. Revenues "only" fell 17% YoY, reflecting the more relatively stable nature of onshore work. As the most material driver for Saipem, OE&C will need to do much of the heavy lifting throughout the recovery. Extracting value from the troubled Mozamabique LNG project will be a top priority, however management has already predicted their ability to keep any fallout cashflow neutral.

The Offshore Drilling segment is made up of 12 vessels- 5 deep water units, 6 jack-ups and a barge tender rig (that was written down over 2020). Revenue proved extremely sensitive last year, falling 40% YoY. The prospects are improving going forward, with all but one of the fleet currently under contract and the fact 6% of global rigs (40) were scrapped over 2020. Resulting future tightness and the time lag to build new rigs would obviously be very bullish for dayrates in a recovering market.

Onshore Drilling was also down sharply, falling 39% YoY and seeing only 36% of its 83 rig fleet utilised as of Mar 31, as opposed to 59% Mar 31, 2020. Utilisation was particularly week in the Americas, while relatively strong in EMEA at 55%.

Risks

Of course, the largest risk for Saipem is a prolonged bottom in energy markets causing lower capex for longer and a slow bleed of the company's liquidity and resources. I do not believe this will be the case, as evidenced by rapidly rising commodity prices over the last six months.

Research from Goehring&Rozencwajg and Horizon Kinetics last year was some of the first to identify the supply destruction Covid-19 unleashed on the energy market. This took the form of well shut-ins and the rolling over of the US shales, which had been the cause of surging supply over recent years.

In any case, it is important to remember that by January 2020, energy markets were already six years into a bear market and the pandemic simply added another insult to a long list of injuries. To do well in Saipem at these levels, all that is required is a return to Jan 2020's, already historically-depressed, profitability.

In the event that E&P capex does take several more years to return, Saipem is well capitalised and a likely survivor in an industry full of shaky balance sheets. The company has already projected post IFRS net debt to rise to 1.6b€, which would be an uncomfortable, but manageable 2.5x 2020 EBITDA, but less than 1.4x 2019 levels, when even a meagre recovery presents itself.

The company is proactively managing their liquidity and debt, while looking through to a return to normality on the other side, stating in their 2020 Annual Report:

"In the second half of 2020, Saipem renegotiated the conditions of the Financial Covenants (defined as the net debt-to-EBITDA ratio) on the main bank facilities, adjusting the calculation according to the international accounting standard IFRS 16 and, at the same time, increasing the limit from 3.0 to 4.0 for the financial year 2020 and to 3.5 for subsequent financial years."

"As soon as the market recovers, deleveraging and gross debt reduction will be again our primary objective."

Further risks include one-off issues, such as the Mozambique disruption or shenanigans related to some of the exotic markets Saipem is active in- the company was dragged into the Petrobras mess in Brazil in 2014 and has faced allegations of corruption in Algeria in recent years (of which, Saipem was fully acquitted).

More recently, Italian prosecutors requested a court in Milan to pursue Saipem for damages, relating to its capital raise in 2016, claiming the company misled the government lender CDP in its outlook, at the time of the sale.

Quite simply, if you are looking for a Buffett-type business that provides a smooth ride and great management, Saipem is unlikely the investment for you. Instead, I believe that all these colourful situations are likely in the price (and then some) and am content that management need only muddle their way through, as they have done before, and I will see a lumpy, but very rewarding return.

Comparables

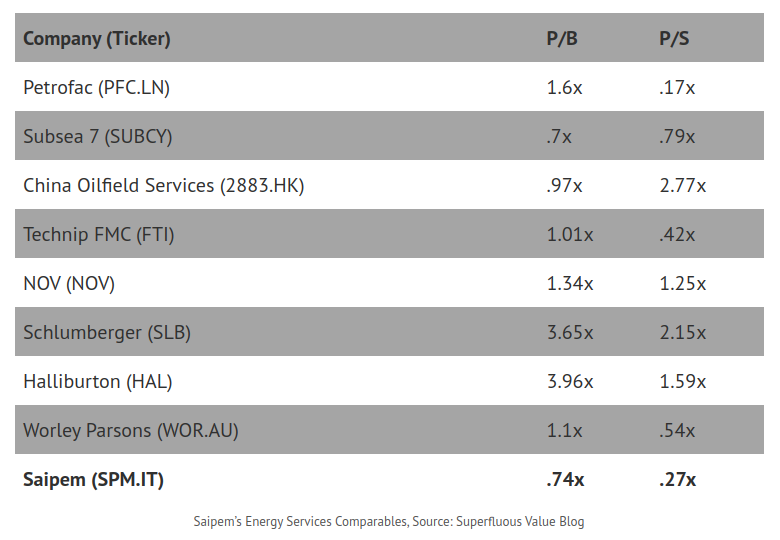

Comping energy services companies can be difficult due to different revenue streams yielding quite divergent valuations. I have attempted to assemble the most relevant comparables for the business and it is clear that Saipem is one of the cheapest and by some margin (due to the extreme cyclicality and operating leverage of these companies near a cyclical bottom, I have chosen to leave out EV/EBITDA).

In my opinion, the best individual comparable is TechnipFMC (FTI), which is unfortunate, as its recent spin-off make its financials more complicated! But FTI, like Saipem, is a globally diversified engineering, construction and maintenance company, servicing the oil and gas markets, while incubating a renewables business it hopes will grow over time. Although, I should note the differentiator that FTI does a higher percentage of offshore work.

Further, FTI has debt/equity of around 50% and solid liquidity, making survival a safe bet. However, unlike Saipem, it trades at book value and .42x sales (adjusting sales for its 45% stake in the spin, held at Mar 31). Until late last year, it was priced at roughly 3x EV/'19EBITDA (roughly SPM's current valuation), before ripping and introducing the highly accretive spin-off of its Technip Energies division.

Valuation

My fair value for Saipem is 8€/share which I expect to be realised over the course of the next energy cycle (5-7 years).

As often, my assumptions are simple and could be considered naive. By forecasting a return to normalised sales of 10b€ annually and a recovery in market sentiment to a price of .8x sales gives a market cap of 8b€ or 4x today's price.

In my opinion, none of the above assumptions are aggressive. The company achieved 9b€ in revenues as recently as 2019 and was priced well above 1x sales during the last commodity up-cycle. Assuming net debt of 1b€, at this point, would be an EV/Sales of .9x- also reasonable given history.

As the energy cycle recovers, Saipem will have the chance to de-lever and will be viewed as a solid business in a roaring industry, but the chance to invest when the outlook was bleak and the price was depressed will likely be long gone.

I have a 6% position in Saipem.

Guy

Please don’t take this as financial advice. Do your own due diligence and consult a professional advisor, if unsure about your finances.