“Overall, we believe that through our operational and inorganic progress, we are set to deliver meaningful adjusted free cash flow growth in the coming years, particularly as synergies are achieved. And it is hard to contemplate any M&A with better risk-adjusted returns than the current opportunity to repurchase our own securities.”

Liberty Latin America (LILAK) CEO Balan Nair on the Q2 earnings call

LILAK has become a tragic joke among investors. During its 6-year public life, the share-price has tanked over 80% and all the way down, the faithful have been pitching it with bullet points like “Malone vehicle” and “leveraged buy-backs”.

While some of this was self-inflicted (the spin price was too high and the company overpaid for C&W in a sweetheart deal), much of the pain was outside management’s control and only cyclical in nature. Hurricane Maria destroying Puerto Rico, Covid 19 and relentless weakening in Emerging Market currencies and sentiment can hardly be laid at their feet.

I don’t believe any of these issues are structural and the current price reflects one of the best opportunities in global markets. An investor just needs to see LILAK as it is today and put aside any baggage they have accumulated on the way down.

The Company

For those unfamiliar with the name, a brief background is in order. LILAK is a telecom provider focused on Latin America and the Carribean, with its primary markets including Chile, Panama, Costa Rica and Puerto Rico. It was spun out of Liberty Global in 2017 and has an outstanding management team led by CEO Balan Nair and CFO Chris Noyes.

The company has a somewhat disjointed geographic base, with the reporting segments Cable & Wireless (C&W) Carribean (36% of revenue), Liberty Puerto Rico (30%), VTR/Chile (16%), C&W Panama (11%) and Costa Rica (5%), with headquarters in Denver. In many of its markets, it offers a “quad-play” bundle of mobile, fixed, video and internet, allowing it to compete vigorously.

LILAK is, of course, part of the Liberty/Malone stable and accordingly runs a highly-leveraged business model, with Net debt/EBITDA of over 4x, but the defensive nature of the business supports this. It is curious that despite the share price down brutally over Covid, revenues hardly skipped a beat over this period. When asked recently if the company was seeing any bad debts or affordability issues in its markets, Nair stated:

“We sell a product that everybody wants, and we've done some surveys, and it's one of the last things people would give up. So we feel pretty good about that.”

John Malone remains a Director Emeritus today and maintains a reasonable holding, including recent purchases.

As a further note for value geeks, the Carribean division C&W features in Peter Cundill’s fabulous book “There’s Always Something To Do”, where he describes it as “the worst investment we ever had”, after piling in at the end of the Dot Com Bubble, just as the then-management were incinerating cash chasing terrible acquisitions. Cundill mentions legend Sir John Templeton was also caught up- so not much has changed on the value, heart-ache front!

Strategy

I have been asked many, many times about corporate strategy at LILAK and believe it is one of the most poorly understood stocks in the market. Concerns are generally based around why there are no earnings or why they have raised capital at the expense of buybacks, at different points. It is natural for investors to want consistency to plug into their models, but this is narrow thinking.

Every decision at LILAK is made by management with the goal of maximising shareholder returns on a 5-10 year timeframe and this has resulted in some apparently contradictory decisions, that need to be viewed through this lens.

For example, in the wake of the Puerto Rican disaster, management doubled down and commited to repairing their infrastructure. Besides being a noble thing to do, when they could have cut and run, this required several years of heavy Capex spend, during which buybacks and other opportunities had to be scaled back. FCF was heavily affected, but there was always a timeframe this would be completed by, and the labours bear fruit.

In 2019, LILAK tripled down by acquiring AT&T’s Puerto Rican mobile and fixed assets for around 6.5x EV/OCF Enterprise Value/Operating Cash Flow- an outstanding price. Despite this, the market grumbled about why they weren’t buying back stock or deleveraging, completely missing the point.

By combining these with their existing PR assets, the company could recognise large cost savings and offer a more complete bundle to customers. Yes, it would delay the buyback story the market was waiting for, but the end result would be even better and the company more competitive in the interim.

Similar confusion arose during Covid, when Nair initially announced a new buyback programme in relation to the plunging stock price, only to pivot and announce a capital raise to fund the acquisition of Telefonica’s Costa Rican mobile business. It wasn’t ideal to raise equity with the price so low, but investors missed the opportunistic nature of the deal.

Combining fixed and mobile in another market, and for only 6x OIBDA (Operating Income Before Depreceation and Amortisation), made perfect sense to a long-term holder and the company had to either do the deal then and there, with a willing seller, or pass for good. The equity raised was minimised through complimentary debt-funding and the new assets brought their own cash flows with them, so I would argue the process wasn’t even dilutive.

This is the fortress mentality I believe Nair exhibits. He would rather start shrinking the share count from a stronger base and will put buybacks on hold if more attractive M&A or organic projects emerge. LILAK’s Chilean operations are another example of this, with recent heavy capex spend to set themselves up in their most competitive market.

Nair is very bullish on the country and, once again, takes a long-term view, well beyond the current government/referendum headlines. The company has also entered into a strategic joint venture with America Movil/Claro to combine their Chilean businesses, allowing them to roll-out fibre and 5G more competitively. LILAK’s share of the resulting synergies should ramp up to around $90m/year, as well as drastically boosting their competitive position. Nair has stated he hopes to see further consolidation to rationalise the Chilean market.

FCF and earnings, or lack thereof, has been a similar point of confusion and mean that LILAK doesn’t screen well for those wanting a cheap P/E or similar. This is inextricably tied to the Malone influence, whose hatred of taxes stretches back to his legendary TCI days. Accordingly, dividends are last in the priority list, as they are viewed as inefficient and simply can’t compete with the returns management can make on their other capital allocation options.

This model calls for booking as much depreciation as possible and spending heavily on capex where they believe it will be rewarded down the track. GAAP earnings aren’t apparent, because management is completely indifferent to them and woud rather defer taxes and grow the pie.

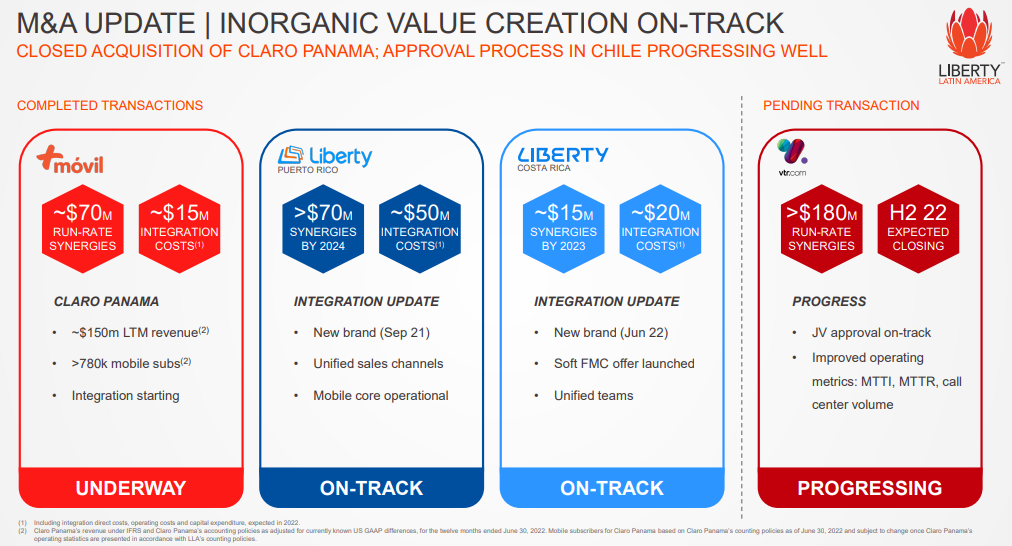

Therefore, looking at recent results and extrapolating them gives a very misleading picture of LILAK’s economic value, which is also exacerbated by the long lag-time in announcing, paying for, intergrating and finally fully synergising acquisitions. For example, note below that the Puerto Rico acquisition announced in 2019 will only be fully synergised by 2024.

As a result, LILAK’s recent cash flow results look strained due to heavy capex spend in Puerto Rico and Chile and its balance sheet looks bloated due to recent deals, but these are all short-term pain for long-term gain. The company already has a steady runway to ramp FCF enormously from now until 2025, simply based on the capex and deals that are already announced working their way onto its books.

For those concerned about the debt, the company will naturally deleverage over the next several years, as OIBDA goes higher by the same process (causing Net Debt/OIBDA to fall). I am personally sanguine on the balance sheet, as the leveage is managed obsessively by leadership, with no major maturities until 2027-28 and all of this siloed at the segment level and completely hedged into local currency (see below). Nair recently hinted that the company is sitting on a large derivative gain from its hedging of the Chilean Peso that it is now partially monetising.

Buybacks, Insider Buying and Stock-Based Comp

As noted above, Nair currently believes it would be a very high bar to find M&A as attractive as simply buying back stock. This is both because the share price is now mouth-wateringly cheap and all the segments have now been shored up, into strong competitive shape. He has stated recently that he sees no distressed, private selling in Latin American telecom, and yet, public investors can’t seem to scramble out fast enough.

Accordingly, on a $1.4b market cap, the company repurchased $65m of stock last year and has ramped this up significantly with a $200m program for 2022, of which $120m had already completed by July. Nair has quoted Malone as telling him that share price dislocations can be a blessing and they are not wasting this one.

Buying back over 10% of equity in a year is something the market can only ignore for so long. It always seems like a bit of a cop-out, but share-holders really will be smiling in a few years if the price stays this low for long. On the Q2 call, Nair stated the buybacks woud remain a priority unless their economies deteriorated significantly, which they see no sign of at present.

As a further positive sign, many insiders have purchased shares directly within the last year, including Noyes (who owns $3.5m of shares, with a base salary of $625k), Nair (who owns $11m of shares in relation to his base salary of $1.25m and maximum bonus of $5m) and Malone (who bought $5m of shares in May and whose holding represents 27% of the voting rights), and it would be impossible to say there isn’t heavy alignment here.

If there is one downside, it is the stunningly large amount of stock-based compensation (SBC)- also a regular feature of Liberty companies. This came to $118m for 2020, $118m for 2021 and is running at $62m for H1 2022, and this must be deducted from FCF for a true picture of owner returns. From the proxy statement, there are still significant option grants from earlier in the company’s life that are unlikely to get hit, but we have to assume/hope that grants made here in the single-digits will be dilutive at some point.

Valuation

I will let Nair himself have the first word on valuation, speaking at the recent Goldman Sachs Communacopia & Technology conference:

“Logically, if you think about Puerto Rico, if you NPV (Net Present Value) the cash flow that we generate there, it’s about a $600m+ EBITDA business, you should get to about eight or nine turns, but let’s even just say it’s seven turns- the value of Puerto Rico alone. Puerto Rico at seven turns is worth more than my whole company combined. So essentially you get Puerto Rico and left over you get you get the rest of my business for free; Panama, our subsea network, Chile, all the Carribean islands. You know, it’s like insanity.”

There are several back-of-the-envelope ways to look view a margin of safety in LILAK. For example, the company owns a unique 50,000km subsea cable network that links 40 markets in the Carribean. This generated $160m in EBITDA in 2021, is currently only used to 10% of its capacity and is almost irreplaceable due to costs and the permissions that would be neccessary.

The Board requested Nair to “test the market” for a price on this asset earlier in the year and there were parties that wanted to talk at his number (a SPAC and a PE firm), but no deal came of it. I believe this network alone is roughly worth $2.4b, based on 15x EBITDA and that it has significant latent capacity. It could possibly be significantly more.

LILAK has guided to $250m of FCF this year (although this has been subsequently revised to $220m due to the one-off, acquisition costs of buying Claro Panama) and this remains on track. Already this is quite stunning on a market cap of $1.4b (5.6x), but, as we know, there are other deals coming through that will boost this number dramatically by 2025.

There are around $100m in integration costs to be covered on already announced deals and initiatives alone, but once these are completed, ongoing synergies of $150-$200m should boost normalised FCF to $280-330m by 2025 (this being $400-450m then subtracting $120m SBC). Implying an incredible multiple of <5x FCF, for a business with strong management, with skin in the game, and a long runway from low internet penetration in many of its markets.

Many will scoff, but as even run-of-the-mill mobile assets are going for 6-7x EBITDA in today’s tough Latam private market, I think LILAK will be re-rated much higher over the next cycle. Ultimately, as Latam assets are let out of the doghouse at some point, fair value lies around 9x EV/OIBDA*, in my view. The path there from today’s 5.2x will, hopefully, shows the wonders of leverage when applied correctly.

Assuming OIBDA grows only slightly from $1.8b today, to $2b after recent M&A and net debt remains constant at $8.1b (including VTR), my target multiple would give an equity value of $9.9b ($2bx9-$8.1b). If $500m could be deployed at prices averaging $10/share over the next few years, the share count would be 174m and a resulting share price of $56/share or 9x today’s price. I don’t think any of these numbers are aggressive, in fact I think they are likely too conservative, but I would love to hear feedback!

Thanks for reading and we’ll see how it plays out,

Guy

I hold a core position in LILAK shares.

*OIBDA is Malone’s preferred metric and gives a very similar number to EBITDA in LILAK’s financials.

As always, this isn’t investment advice. Please do your own due diligence and seek professional advice if you’re unsure about your finances. This is especially important as LILAK is a HIGHLY leveraged, small-cap security operating in Emerging Markets.

Really appreciate the write-up. Thanks. A few question if I may, starting with the most important one:

What are your thoughts on how they prevent what happened in Chile (6 to 7 players coming in), happening elsewhere? I am aware of the following quote from Balan Nair but thought I would get your thoughts as it suggests there could be a serious issue with pricing power (will/has an end of cheap capital meant this will be prevented?): "To your second question around is this a contagion that can spread elsewhere? We've looked at every one of our other markets, and we don't see anywhere else going to a 6 or 7 player market on the fixed side. And certainly, we've learned a couple of things as well to be ahead of the game before it becomes a 6-7 player market in any other location. So if you look at Costa Rica or Puerto Rico, these are 4 million type population centers, Costa Rica, slightly north of that, about $5 million; Puerto Rico, about $3 million to $4 million, Panama about $4 million. These are smaller geographies that won't attract 6 to 7 player competitors. So we feel relatively confident."

How much in the past did they spend on the repairs on the back of the terrible Puerto Rico hurricane? Should the fact that such a hurricane may happen again be considered in their valuation? Have they made any efforts to prevent future issues like this, for eg insurance?

You mention that they should be re-rated much higher in the next cycle. Can you define this "cycle" and when will it be?

Obviously the increasing fcf and buyback may act as a catalyst and a possible sale of the subsea asset.

It certainly appears private market value for these assets are much higher than public.

Thanks

Hey

Whenever they talk about their FCF they mention distributions to partners. Please forgive my ignorance but what does this "distribution to partners" mean? Does it mean that not all the FCF goes to shareholders? For q2 adjusted FCF they give $31m, they then mention $41m distribution to partners and give a total of $72m before distributions. Thanks.