Gazprom: The Ultimate Inflation Hedge

Gazprom is one of the most polarising companies in global markets, but in my experience, those that dismiss it citing Russia, Putin or the oligarchs are looking through biased lenses and passing prematurely.

I view the company not only as a potenitial multi-bagger, but as one of the market's best inflation hedges. If inflation gets out of the bottle, owning the world's largest gas reserves, 95% of one of Russia's best run oil producers and 177 000kms of pipelines (just within Russia) at a fraction of their replacement cost will be a pretty good place to be. These assets alone dwarf the current market cap, but there are also plenty of other income generating assets thrown in for free including power generation, property, banking and media.

Admittedly, I don't think even the bears are arguing that Gazprom is expensive. They are instead focusing on what they view as systemic corruption and mismanagement in Russian corporations, as well as the risk of geo-political tensions and sanctions.

These concerns are valid. Of course, no one investing in an semi-autocratic region can ever be 100% certain their investment won't be taken from them, but it is lazy analysis here in my opinion.

Investing is about taking smart bets. For the bears to be proven correct, there not only needs to be a cataclysmic event, but it needs to come soon. So immense is the dividend yield the company is throwing off (even after doubling off the lows), that it is likely to return an investor's capital in around eight years and possibly much faster.

As each year passes, the potential wipe-out in such a scenario shrinks and the company's value grows. Investors will likely ask themselves the next time EM companies are in favour what all the fuss was about. Heads I win a lot, tails I lose an ever smaller percentage of my initial capital. I am not advocating for Gazprom as a 20% portfolio position, but can very easily find a place for such a situation amongst my holdings.

Close observers will also note the the company's capital allocation and shareholder practices are strong and improving. On top of the dividend policy being phased in, Gazprom endured many years of onerous capex building out its network, most recently the Turkstream and Power of Siberia pipelines, under deep investor skepticism and a flattened share price. The will to push through that period has set the business up to generate these exceptional cash returns going forward.

Alexey Miller has led the company since 2001 and was reaffirmed for another five year term in February. Miller is a longtime Putin ally and likely to continue the same agenda of further growth in China and a razor focus on completing and ramping up Nord Stream 2. It was Miller who drove the dividend policy update in 2019, moving to a 50% payout of annual adjusted net income, provided that net debt/EBITDA remained below 2.5x.

You have to ask yourself, why would a company that wanted to rob foreign shareholders blind approve such a policy? I honestly wish that more energy companies I watch would follow suit. More likely, the Kremlin has decided to monetise the energy juggernaut at its disposal.

2020

Of course, last year was a brutal year for Gazprom. Short-term profitability was laid to waste with revenues falling from 7.3Tr RUB in 2019 to 6.3Tr RUB in 2020. This was equal in measures due to a drop in total production by 8% to 3,428m BOE (Barrels of Oil Equivalent) and the precipitous decline in energy prices over the first half.

The company was able to reign in capex, but not enough to save margins with operating cash flow falling 21% to 1.3Tr RUB and net profit down 89% to 135b RUB. Net debt/EBITDA also blew out to 2.6x.

But if you take the long-term view, 2020 was a very solid year with no damage done to the company's terminal value. Gazprom replaced its production with new reserves as it has done every year since 2005, with total reserves now at an astounding 178.5bn BOE, including 24,521bcm (billion cubic metres) of natural gas and 1,403mt (metric tonnes) of oil (see below).

It remained the world's largest nat gas producer by a wide margin, with 11% of 2020 global production and retaining 16% of global reserves. The hydrocarbon that must be, and I believe will be, much further promoted in the global energy mix as a lower carbon intensive alternative to oil and coal.

Turkstream saw its first delivery of gas to Turkey and the Balkans and Power of Siberia had its first full year of delivery, transporting 4.1bcm to China. Further, a 4.2% dividend yield was paid, despite atrocious industry conditions and the net/EBITDA ratio should fix itself with the snapback in profitability (to pre-pandemic pricing) energy markets are now experiencing.

2020 also gave a 50% off sale in one of the most stable, well-reserved energy majors on the planet.

The energy recovery

Ardent readers will know I have owned Gazprom for some time and first wrote about it over a year ago. In that piece I opened:

"One of my favourite set-ups in a business includes what I think of as the toxic trio- a company that operates in a hated sector, within a hated country, with a hated currency. If a stock has these three traits there is a good chance it is priced as a bargain."

Since the worst of the meltdown last year, Gazprom's share price has recovered, but still reflects a very depressed energy environment. I have argued before that 2019 was already deep into an oil and gas bear market and drastically undervalues many of the world's vital energy producers.

So where to from here?

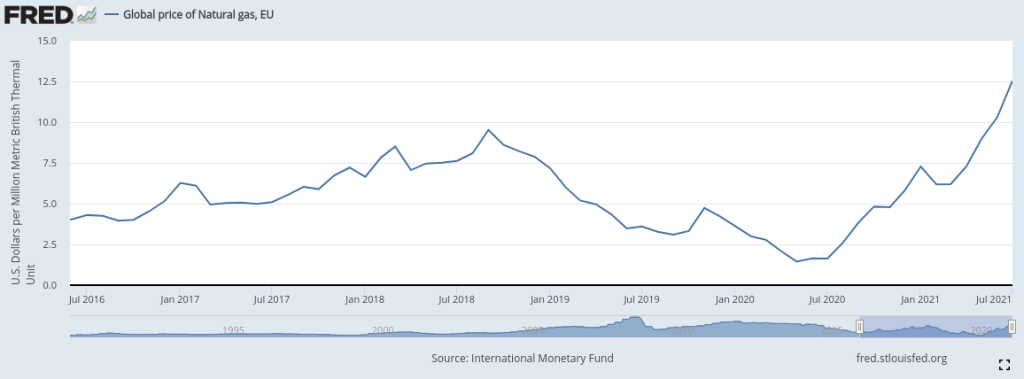

It seems clear that a major energy recovery is underway and 2021 will be a comparatively strong year. Gazprom already reported that Q4 2020 was stronger than Q4 2019 with revenues up 3% YoY. Also bullish is Brent Crude ytd averaging $66.30 vs $64.30 in 2019 and, most importantly for Gazprom, European natural gas surging over 120% this year on a shortage across the continent. The company appears to be flexing its muscle in this regard, in a position of power supplying 1/3 of the Europe's gas.

Below is my best approximation of 2021 financials incorporating the above, as well as assuming a return to 2019 production levels, plus Turkstream and Power of Siberia, and a loosening of the opex/capex belt that was tightened last year with the crisis.

ItemEstimated 2021Revenues8.1tr RUBOperating Expenses6.5tr RUBOperating Profit1.6tr RUBDepreciation820b RUBOther EBITDA adjustmentsNet to zeroAdj EBITDA2.42tr RUBProfit Margin18%Net Profit1.46tr RUBDividend10.40%Current EV10.5tr RUBEV/EBITDA4.3xNet debt/EBITDA1.4x

Why Gazprom Can Multibag From Here

There are multiple drivers I believe will work to produce a great return from Gazprom; multiple expansion, the growing dividend and currency appreciation.

Firstly, Emerging Markets equities have been out of favour for much of the last decade and energy related companies especially so. It is easy to forget that Gazprom had a market cap of close to $300b towards the top of the last EM cycle. I view fair value today at 8x EV/EBITDA and 11x net profit or 15.9tr RUB. I believe these multiples are very achievable with a view across the trough in EM value sentiment.

Secondly, Gazprom's already impressive dividend is likely to grow with energy demand, expanding production and the continuing pricing recovery, but even assuming no growth in the dividend, Gazprom will pay you to a double-digit yield to wait for a re-rating. This is obviously very attractive in a low-rate world and can only be ignored by the market for so long.

And thirdly, the Ruble is extremely depressed and, unlike other EM countries I have written about, doesn't have problematic inflation (under 5% pa since 2016). On a PPP basis, the currency is currently 60% undervalued against the USD and highly likely to mean revert with improving commodity prices. I will assume appreciation back to a 20% PPP discount- which would add a third to the share price in USD terms, given the company earns around this amount of its revenues domestically.

I expect a lot of pushback on the currency, but there is really no fundmental reason for the Ruble to be so washed out. Debt to GDP is a very modest 20%, the economy is improving with the oil price and the US inflation rate may actually soon be the higher. Capital flight and liquidity are the sole explanation and this sentiment can improve very quickly.

Combining these factors, I calculate the fair value of OGZPY at $24 or 3x today's price, with a healthy dividend for your patience and substantial inflation protection baked in.

I have a 7% portfolio position in Gazprom- OGZPY.

Guy

Please don’t take this as financial advice. Do your own due diligence and consult a professional advisor, if unsure about your finances.