Barrick: The Best Hedges Are Those You’re Paid To Take

If you are hunting for a sector that is a long way off its highs in the midst of a bull market in just about everything else, look no further than precious metals.

I have a 4% weighting in Barrick Gold, but I view it very differently to many stock pickers and am aware there are cheaper miners out there. I also don’t have a particularly strong view on the gold price. I have seen the case made for much higher prices, but I wouldn’t want to be all in on this scenario.

I see gold as a useful potential hedge in a portfolio, not necessarily going to rip inversely to a crash, but as a source of uncorrelated return over time. Barrick played this role very healthily last year, when it was the saviour of my portfolio, rising in weighting from 6 to 18% as my value equities plummeted. My timing was very lucky to trim it back to a 6% position at around $30 later last year.

Why a miner over physical?

One of the obvious and often heard arguments against owning physical gold is the lack of cash flows and hence, the difficulties in valuing it. Miners solve this issue, with analysable cash flows and dividends. Barrick’s regular dividend is now at 1.9%, a fair pick-up on the S&P500’s 1.3%, with additional special dividends of 42c this year.

Clearly, Barrick’s cash flows are derived from the underlying gold (and copper) price, but this has had value for thousands of years and I am prepared to trust the Lindy Effect that this will continue. In my opinion, being paid to wait removes much of the angst around precious metals exposure.

Operational leverage is another appealing feature for the miners, but is a double-edged sword. With substantial fixed costs, the magnifying of profits when the gold price rises gives stronger returns to the miners and the inverse when it falls.

This is the crux of why I prefer Barrick. I am looking for modest operating leverage (but not financial) to the gold price in the safest way I can find it. A large, debt-free, diversified, low-cost miner with capital discipline won’t run as hard as many of the juniors in a bull market, but will hurt a lot less in a bear.

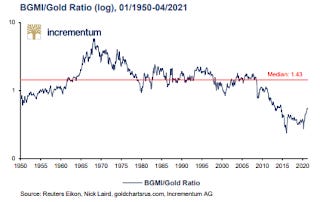

Perhaps the most compelling reason for preferring miners currently is their historical cheapness to gold. The chart below from the outstandingly thorough In Gold We Trust report is illustrative. The Barron’s Gold Miners Index (BGMI)/Gold is in the midst of a multi-year underperformance against the gold price, measuring .52 today (917/$1752), against a 50-year average of 1.43, implying gold miners could rise 175% on no fundamental improvement, just to restore this ratio to its historical mean. Such a discrepancy could make sense if the gold price fell below the aggregate cost of production, but at current prices, the industry is minting more free cash flow than it ever has.

A huge part of my philosophy is based around mean reversion and I find opportunities this stark extremely appealing. It seems intuitive that in a strong gold market, sentiment towards the related equities could drastically improve.

The company

Barrick is the world’s second largest gold miner behind Newmont. It has a geographically diverse footprint, with its six tier one mines in the United States, the Dominican Republic, Mali and the Democratic Republic of the Congo, as well as a portfolio of lower grade mines spanning North and South America, Africa, Saudi Arabia (copper) and Papua New Guinea. It is considered to have some of the best, longest-life assets in the industry.

The company added impressive scale through a transformative merger with Randgold in 2019, with Randgold’s CEO Mark Bristow taking the merged CEO role. I have been impressed listening to Bristow, he strikes me as shrewd and it is fair to say he is regarded as one of the best operators in the industry.

As a result of his history with African-focused Randgold, he has extensive experience dealing with developing world governments, evidenced by his success bringing the recently acquired North Mara and Bulyanhulu mines to full production in Tanzania and ongoing negotiations to reopen the Porgera mine in PNG. Barrick is now executing a 10-year plan to make North Mara and Bulyanhulu its seventh Tier One asset, by vastly lowering their cost curves.

Bristow has been a loud advocate for consolidation in the industry, even launching a hostile bid for Newmont in 2019 that many saw as a joke, but would result in the Nevada Gold Mines Joint Venture between the two, with Barrick holding a 61.5% stake.

The company is lean with a H1 2021 All-In Sustaining Cost (AISC) of $1052.5/oz, comparing slightly favourably to the industry’s $1058.5/oz.. This average is heavily skewed by the scale of the large producers and shows the larger safety the majors offer- they simply remain profitable at much lower prices. One curious note was Barrick reiterated its guidance for a $970-1020 AISC for 2021 in its Q2 report, but this seems unrealistic given H1’s result.

Further, it has shown great restraint and discipline by reducing net debt of $13b eight years ago, to a measly $14m today, through earnings and non-core divestitures. What debt there is doesn’t mature until 2033 and the company has signalled that it will continue to return cash surplus to growth requirements to shareholders.

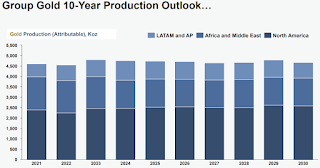

The entire industry is defying the ingrained perception that gold executives will race to destroy value at the first sign of higher prices. Capital returns, steady production and balance sheet discipline are the new normal, if anyone cares to notice and Barrick is the gold standard for this framework. Barrick has forecast steady production on its 10-year guidance (see below, source- Barrick filings) and will reap a higher price, without smothering it, if this plays out.

It would also be remiss to mention Barrick’s copper producing assets, which contributed 6% of revenue in 2019, consisting of Lumwana (Zambia), Zaldivar (Chile) and Jabal Sayid (Saudi Arabia) in order of importance. While a small overall contributor, Barrick has received no dispensation relative to other gold miners for these assets, given that copper has doubled from its Covid lows and currently sits near decade highs.

Valuation and Outlook

I don’t claim any ability to forecast the gold price. Although, there are certainly a number of macro contrarians anticipating higher prices due to inflation and a comeback in real assets, which would certainly see a multibagger for Barrick owners.

Credible arguments for a lower gold price are few and far between, but I would suggest this 2018 piece from the fiercely independent-minded Lyall Taylor’s blog as a counter. Taylor points to downside tail risks in the gold price, related to the fact that gold isn’t consumed, like many commodities, and must rely on global demand recurring at a given level each year to support its price. I don’t dismiss this possibility, but suggest its effects would be temporary (due to low prices curing low prices) and see this as another reason to favour a large, low-cost producer.

This lack of a forecast is quite liberating and allows the business to be viewed as it is today; very cheap.

On a consolidated basis, Barrick trades at 4.3x LTM EBITDA, 10.5x LTM FCF and 1.9% dividend yield (with additional cash returns very likely), all of which seem sustainable going forward. While I am loath to give a target price, given the number of moving parts and the false precision that would imply, these fundamentals in a business that is improving operationally and showing capital discipline are incredibly attractive. These numbers also don’t account for the above-mentioned Porgera Mine (PNG), which accounted for 5% of 2019 revenue and remains offline pending negotiations.

Highlighting the modesty of Barrick’s current valuation (Market Cap and EV of $32.4) is a comparison to 2011, the last time gold prices were above $1750/oz. Barrick attained a market cap of $50b and an EV of $63b, despite comparable gold and copper revenues for 2011 and 2020. This is consistent with the undervaluation of the miners to the gold price (discussed above), providing a protective cushion to the investment.

I believe Barrick is a safe and undervalued exposure to the gold price, with modest operating leverage and strong management. It is, in effect, a hedge you are paid to take.

I have a 4% position in Barrick Gold.

Thanks for reading,

Guy

As always, this isn’t investment advice. Please do your own due diligence and seek professional advice if you’re unsure about your finances.