Babcock International: An Inverted Short

I spent my run last night listening to Brandon Beylo's thought-provoking interview with Dan McMurtrie of Tyro Partners on the Value Hive podcast. I am only part-way through (it's over three hours), but the level of differentiated, independent thinking is already impressive, with the most interesting being McMurtrie's discussion of "Inverted Shorts".

An Inverted Short is based on the what McMurtrie calls the 180 Principle, where by the time an investor is looking to sell a holding, it may be worth considering as a short and inversely, by the time a short has run its course, it may be set up as a strong long. Due to the natural dynamics of shorts having a limited gain vs the theoretically unlimited upside in a long, a short where the thesis has "expired" is potentially set-up for explosive gains.

The concept is fascinating and allows for the, at first seemingly remarkable, mental gymnastics of buying a company you previously believed the short thesis on, but its strength comes from many of the institutional behaviours and constraints exhibited by the other investors still involved.

I have no idea whether McMurtrie would agree with his concept being used in this situation (his example was fast-growing beverage producer Celsius Holdings), but I thought immediately of my holding in UK defence contractor Babcock International. The former short favourite that appears to have had a narrative shift and is now recovering under new management.

Babcock is the UK's second largest defence contractor (after BAE) specialising in naval, aerospace and security, making 67% of its revenue in the UK, with significant specialist contracts in Canada, South Africa, France and Australasia. Its largest customer is the British Ministry of Defence (MoD) at 38% of revenue. Despite several years of issues, at its core, Babcock is a consistent and profitable business, maintaining a steady backlog and considerable niche expertise.

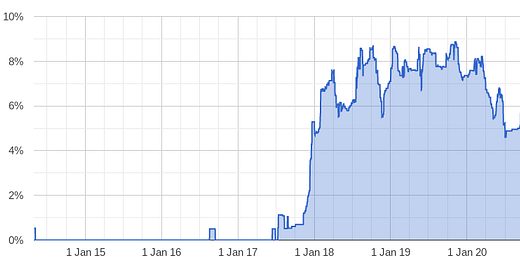

The company was the topic of two short reports from The Boatman Capital Research- Babcock Interntional: Burying the Bad News in October 2018 and Babcock International: Underperformance and Overcomplexity in May 2019. Both were widely reported and accompanied a surge in short interest in the company (see below).

The main accusations were around Babcock's deteriorating relationship with the MoD, declining core profitability, the need to write down several acquisitions, cost over-runs on several projects and accounting obfuscation and they were right, with a series of profit warnings and its own ineptitude crippling the company over several years.

But Boatman never argued Babcock was a zero. In fact they acknowledged that it was a "much better business with some impressive capabilities" than Carrilion and Capita, who had set investors jittery around government contracts, with their collapses earlier in 2018. They also praised the appointment of Ruth Cairnie as chairwoman in early 2019 and encouraged her to push for change at the company.

Perhaps the most significant issue was that the two Boatman reports were written with Babcock stock at £6.72 and £5.19. Drastically lowering the price can radically change the expectations on a company.

Covid-19 slammed the business, with much of its work carried out on fixed-price contracts that were now much more personnel and time intensive, due to delays and social distancing. Margins free-fell accordingly, as full year 2021 results (March-March) would bear out, despite only a 3% revenue drop, operating margins had cratered from 8.5% to 5.3%. After Babcock initially rallied as the vaccine announcements sent most recovery prospects rocketing higher, the share price returned to languishing under uncertainty around its financials.

I had observed the company for some years and was aware of a long stream of value investors burned thinking Babcock would turn around. With perfect hindsight, it is now clear this was highly unlikely under the leadership of former CEO Archie Bethel, however his September 2020 replacement David Lockwood was a very promising adddition, having successfully turned around aerospace manufacturer Cobham, before a private equity buyout.

The final capitulation hit in late January, as Barclays claimed Babcock would need to raise as much as £600m in equity, stating:

"In our view, uncertainties such as outlook/balance sheet/earnings reset, as well as the absence of guidance, will prevent many investors entering or holding the shares near term despite an optically attractive valuation."

The irony was Babcock was more investable than any point since the GFC, selling for around 3x its pre-pandemic 2020 EPS of 69p (these were subsequently restated at 58p or 3.6x post-review). Babcock was a stable business that looked like a cyclical due to extreme margin-pressure during the pandemic, but its order book remained as strong as ever and I believed margins could almost fully recover post Covid.

In my opinion even the feared equity raise wouldn't have been a negative, as assuming a £600m raise on £1.2b market cap (or 1/3 dilution), the company would still only be on 4.6x normalised earnings (5.4x restated) and would be much safer with this new equity buffer. I bought a 5% position at 220p the day after Barclay's report.

The short case had expired, however years of disappointment and losses were hard to shake for those who had been close to the situation. I was amused to be met with equal measures of pity and horror when vocalising my long stance. It is probably fair that the shorts feel most self-assured just as the price has removed the safety they had in their position (in a non-zero, of course).

McMurtrie further explains the return-profile on his inverted short thesis:

"You may realize that there's actually only one outcome that takes the stock lower and any other outcome, including nothing changing, will take the stock much higher.

"Often shorts that are no longer good shorts are actually fantastic longs. And just by the mathematics of long versus short, the return profile of buying things that are no longer good shorts tends to be very, very good. Particularly if you're there at the beginning of that move, because these things tend to really push themselves. So there's a lot of people like to pyramid into their trades and, for good reason. But that ends up in situations where people are really heavily short something where even a light breeze can send a stock up 50 or a 100 percent."

In April, Lockwood announced the awaited restructuring plan, outlining 1000 job cuts, £1.7b in impairments with more to come, substantial negative restatement of previous financials including debt and £400m of neccessary asset sales- but he pledged to achieve it without raising equity and the share price rallied 30% on the day. When apocalyptic is expected, merely awful can be a huge positive surprise.

Outlook

I don't mean this to be a victory lap, I have plenty go badly against me and Babcock will continue to be volatile (with a lot of work still to do), but the worst case appears to have been taken off the table and the stock has rallied up to 377p at time of writing. In spite of this appreciation, I still see substantial upside from here, with multiple ways to win.

Firstly, a buy-out. There has been recent activity in the UK defence sector, with Lockwood's old firm Cobham purchasing peer Ultra for £2.57b. Part of Babcock's share price creep has been rumours of two PE firms sniffing around the company.

Secondly, good old-fashioned re-rating. Given that the company is selling off some of its income producing assets, the restated, pre-Covid EPS of 58p is no longer applicable. I have revised it down to 40p (conservatively in my view) and estimate fair value at 15x or 600p. These are simplisitic assumptions, but given Babcock's predictability in a non-Covid environment, strong order book and my conservative downward revision, I think they are quite achievable. Especially in an environment that sees a recovery in sentiment towards UK equities.

And finally, debt paydown. Those who have followed this blog for a while will know I'm a huge fan of Dan Rasmussen's model of a leveraged company paying down debt as an optimal way to increase shareholder value, while simultaneously making the entity safer. Babacock has a history of debt paydown, having chipped away at debt consistently since buying Avincis in 2014. Fortunately or unfortunately, depending on your point of view, the business will have the chance to do so again.

Currently, Babcock has net debt of £1.7b (including £582m of operating leases) against a market cap of £1.9b. The company has pledged to lower leverage and won't be paying dividends until at least 2023 for this purpose- there is unlikely to be any empire building acquistions for some time. This is the simplest and most sensible way to accrue further value to the equity.

This article wasn't intended as a deep dive, instead I hope to have conveyed what I see as Babcock's main drivers and why I believe the company can rerate much higher with much uncertainty cleared, greatly improved management and the equity raise scenario shelved.

I highly recommend the Dan McMurtrie podcast and please reach out if you have any examples of Inverted Shorts!

I have an 8% position in Babcock International.

Guy

Please don’t take this as financial advice. Do your own due diligence and consult a professional advisor, if unsure about your finances.