Antero Resources: How to 20x Your Money (After a 96% Drawdown)

Amazon is all-too-often talked about as one of the reasons why investing in perpetual winners can work out, even at bubble valuations. Buying Amazon at its peak in 2000 would have seen a +30x return if held till today, which is currently being used to justify nosebleed multiples on the most questionable of NASDAQ listings.

The counter I, and others, put to the bulls is; even if you pick the Amazon from today’s growth haystack, would you hold it through something similar to the 96% drawdown from dotcom peak to capitulation point in late 2001? Unless you are Jeff Bezos or Steve Mandel, history and human nature say you wouldn’t.

But ironically, I have now achieved this dubious honour, and in a much dicier company than Amazon, having recently broken even in Antero Resources after buying for $18 in 2018 and riding it all the way down to a 77c low in March last year- a mere 96% interim drawdown!

In hindsight, my original buy based on a discount to what I thought was a conservative PV-10 at the time proved hopelessly naive, regarding the glut of natural gas that would keep hitting the market in wave after wave. I went through many of the stages of grief watching it tumble and the urge to sell under a dollar, and prevent it from tormenting me every time I checked the portfolio, was very real.

That’s amazing Guy, you added near the bottom, right?

Glad you asked… of course I didn’t.

The company was a genuine contender for bankruptcy near the lows and I was just glad to have had the awareness that it wasn’t worth selling at that point and would either recover somewhat or go to zero from the remaining tiny portion of my portfolio.

My hat goes off to the bargain hunters who have now 20xed their money off the bottom. I was feeling too sorry for myself to join them, although I am grateful all the same. I purchased AR as a 4% position and despite it being less than this now due to the appreciation of the rest of the portfolio and new funds, avoiding wipeouts is such a vital part of compounding capital that scraping out of this one feels very fortunate.

Antero and the Natural Gas Trainwreck

The company was formed by Paul Rady and Glen Warren in 2002 after successfully exiting their previous venture, Pennaco Energy, and went public in 2013. Today Antero is the fourth largest American producer of nat gas (behind EQT, Exxon and Southwestern) and the second largest of NGLs (Natural Gas Liquids), with daily production averaging 3.25 Bcfe (Billion cubic feet equivalent) in Q3.

Antero’s fields are exclusively within the Appalachian Basin and span some of the highest quality acreage in the US, namely the Marcellus and Utica Shale. The company also boasts a 29.2% stake in its former spin-off, Antero Midstream (currently worth $1.5b), which is a potential source of liquidity and currently paying strong dividends to the parent.

Regardless, these advantages weren't enough to outrun the crushing 15-year gas bear market, brought on by the shale boom, global LNG proliferation and a wall of cheap money insistent on financing even the most marginal drillers.

The chart below showcases the pain of Nat Gas Spot grinding to newer lows for 15 years, with only the occasional, weather-related spike. This is the sort of market that sees a leveraged producer decline from as high as $66 to .77c.

Excellent management allowed Antero to escape through the eye of a needle early last year and now sees the company less leveraged and leaner than any point in its history. Paul Rady remains the CEO and his desire to protect his investment and additions to his position near the lows were a bull flag to those who took advantage.

A key part of the company’s survival was its clever use of hedges, allowing it to ride out the storm while indebted peers, such as Chesapeake, entered bankruptcy. Without cash flow, Antero wouldn’t have been far behind, but gas prices bottomed at just the right moment. The company’s remaining hedges now look set to roll off as the recovery gains considerable momentum, with only 50% of 2022 gas production hedged and full exposure to NGLs.

If there is a positive side to the industry’s horror run (besides the pricing for those who didn’t shoot too early), it is the efficiency forced upon the E&Ps to survive it. Currently, Antero sports an impressive $1.48/MMBtu breakeven on its natural gas operations and has reduced net debt to $2.3b and net debt/EBITDAX to 1.6x from $3.8b and 2.2x in Dec 2018.

The following comparison from Antero’s August presentation is illustrative of just how remarkable this transformation has been. Thanks to earnings improvement and paydown discipline, the company now boasts conservative debt metrics, relative to its peers.

I have written many times about my reverence for Dan Rasmussen’s framework of a leveraged company paying down debt, with genuine free cash flow, being one of the most effective forms of shareholder value creation. This allows debt to transfer to equity value (tax-free) at a constant enterprise value and allocating capital this way cuts down available cash for executives to do dumb things.

Unfortunately most managements don’t undertake such sensible policy independently and are generally forced to do so, only once they have been exposed as too indebted. While I respect Antero’s management, this is somewhat the case here. They reached a point where drastic debt paydown was the only hope to survive the cycle and to their credit, they have made a huge success of it thus far.

Management have stated their desire to continue this and reduce net debt under $2b, before commencing capital returns to shareholders. This should happen in fairly short order with the company now set up to generate significant cash over the medium term. Previous investments are now paying off, with drilling and completion (D&C) spending and Marcellus Well Costs both declining significantly.

Today Antero’s impressive reserves include 10Tcf (trillion cubic feet) of natural gas and 1.2 billion barrels of NGLs for total proved reserves of 17.6 Tcf equivalent, with 58% of their acreage currently undeveloped. The company’s fields are the envy of Appalachian peers, with 15 years of NGLs at current projections and significantly longer capacity in dry nat gas.

Antero is the strongest producer of NGLs within the region and also has a superior transportation network, allowing it to export its production further and take advantage of out-of-basin pricing. This can be seen through its consistent and considerable premiums to NYMEX levels. The current surge in C3+ liquids (mostly propane and excluding ethane) has also provided an arbitrage for the company, as the most export capable player in the region.

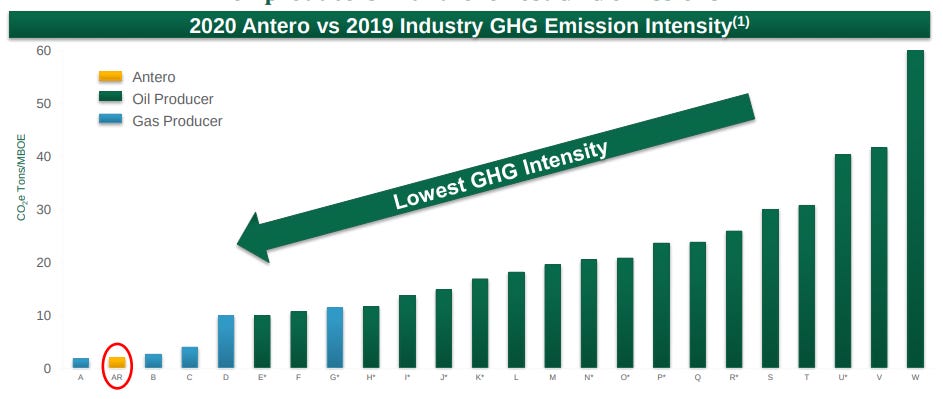

Significantly, Antero is an industry leader in fighting climate change. As the least emission intensive hydrocarbon, nat gas is already at a political advantage to oil and even within gas producers, Antero has one of the lowest emission footprints. The company has committed to net zero emissions by 2025 and reduce their, already low, methane leak loss. In a future likely to see increasing energy demand and climate scrutiny, the company is set up to be a major winner.

As it stands

It is an obscenely rare thing for a company to appreciate 27x in 18 months and still be reasonably valued, but that is the case here. The rapid fundamental improvement in the gas industry and the removal of the steep, potential bankruptcy discount by the market has left Antero still trading at a modest discount to peers.

In this week’s Q3 results, management increased their 2021 free cash flow estimate from $750m to $900m. Quite undemanding on a $6.4b market cap (7x FCF), with further cash improvement forecast going forward. Production and realised pricing were also strong with a $1.14/Mcfe premium achieved over the Nymex average for the natural gas equivalent of Antero’s output.

But this is where it gets a little trickier. The company guidance is “based on today’s strip prices” which have risen sharply on the back of shortages, primarily in Europe and Asia. To accept this outlook, we need to cross over into the dark arts of commodity forecasting. There are many pundits now calling for an all-out, hyper-inflationary energy crisis and they may be right, but it is a dangerous scenario to bake into your return assumptions, with other seasonal factors such as Hurricane Ida potentially warping on the market.

Here is a look at recent Henry Hub pricing from the EIA:

Clearly natural gas has risen dramatically since bottoming last year, and this was long overdue, but with some of that now realised by the market, the question becomes about what will be a long-term, sustainable price going forward. This is a difficult question to answer and is much more nuanced than merely whether prices will be squeezed higher this Northern Hemisphere winter.

Paying cheap looking multiples for E&Ps on what turns out to be peak profitability is a perennial top-of-the-commodity-cycle phenomenon.

On balance, despite being weary, I don’t believe that is the case here. The nat gas market seems to be too structurally undersupplied in the near-term and there isn’t the visibility to see where new inventory is going to appear from. Baker Hughes data supports this view, with the US gas rig count at only 99 currently, up only 35.6% YoY from generational lows- hardly enough to flood the market as energy demand continues to recover post-pandemic.

One feature of the recent meme and growth idiocy in the broader market has been the continuation of trends well past reasonable limits (in my view at least). The tendency of value investors to sell far too soon when something is working is a real threat to their returns, after having been around at the bottom and done the hard work. I am working to try and mitigate this instinct in my own portfolio and not be too conservative in my outlook.

The temptation is powerful to sell at breakeven and forget about the whole thing, but I am trying not to anchor on price. I want to leave myself open to positive surprises, as Antero becomes investable to generalists again and commences a dividend in the near future.

I will revisit my holding again and compare with alternatives if the company reaches 10x 2021 projected free cash flow- a $9b market cap or 44% upside from today.

I own shares in Antero Resources.

Thanks for reading, all feedback welcome.

Guy

As always, this isn’t investment advice. Please do your own due diligence and seek professional advice if you’re unsure about your finances.